Proximo Weekly: Europe, not the US, needs to unlock US LNG exports

The US is well placed to meet the European need to wean itself off Russian gas. But Europe needs to decide whether 2022 is the year it commits to long-term contracts with US producers.

Pipeline politics have long bubbled up in the global project finance market, almost always in the context of routes to market for the gas produced by Russia and its former territories. But for a long time, liquefied natural gas (LNG) and piped gas were viewed as complementary sources of supply, particularly for European consumers.

But now the choice between piped gas from Russia and LNG exports from pretty much anywhere else in the world is looking very binary. Germany cancelled the operating permit for the Nord Stream 2 gas pipeline on 22 February – the day after Russia recognised the separatist provinces of Donetsk and Luhansk.

Pipeline write-offs

Nord Stream 2 would have increased the ability of Russia to bypass Poland and Ukraine in delivering gas to Europe by doubling the first Nordstream section’s 55 billion cubic metres per year (cmpy) of capacity. It has had a tortured development history, marked by delays to its construction and financing. At one point – in 2016 – the pipeline was likely to have been financed by European ECAs, with SG, UniCredit and Russian Project Finance Bank mandated as financial advisers.

But by 2017, Gazprom (50%) and Uniper, Wintershall, Royal Dutch Shell, OMV and Engie (each with 10%), had agreed to finance construction of the project with shareholder loans. Despite mounting US opposition from 2019 the consortium gained most of its construction permits and completed construction in 2021.

With Germany’s cancellation and sanctions on a wider variety of Russian business, the Swiss project company for Nord Stream 2 was reported to have laid off its staff and is considering insolvency proceedings. Now at least one consortium member – Uniper – says it will write down its shareholder loans and will attempt to sell its stake - but will honour its existing agreements to buy 19 billion cmpy from Gazprom.

Despite widespread revulsion at Russia’s conduct, and severe sanctions, Europe’s utilities continue to buy gas from Gazprom. They have continued to do so since 2014, when Russia occupied the Crimea, about 100km from the point where the South Stream pipeline leaves the Russian mainland.

Regas revolution

Germany followed the cancellation of Nord Stream 2 with the announcement, three days after Russia invaded Ukraine, that it would accelerate the development of two LNG receiving terminals with a total regasification capacity of 20 billion cmpy, at Brunsbuttel (8 billion cmpy) and Stade (12 billion cmpy).

The two projects have been mired in permitting delays and faced strong opposition from NGOs. A third proposed facility – a 10 billion cmpy floating unit – was reworked as a hydrogen terminal by developer Uniper in 2020. All three have faced doubts about whether they could attract sufficient volumes at a time of heightened price volatility in natural gas prices. Now KfW is going to buy a 50% stake in Brunsbuttel on behalf of the German federal government, with the Netherlands’ Gasunie retaining the remainder.

Russia is estimated to account for about 140 billion cmpy of Europe’s 300 billion cmpy per year in gas imports. The two German facilities would be small part of reducing Europe’s use of that Russian gas, alongside energy conservation measures, renewables and the cultivation of new sources of gas supply, particularly in the North Sea and Caucasus.

LNG is thought to be among the more responsive of the replacement measures, though any discussion of its role in replacing Russian supplies needs to mention the long lead times required to develop any LNG infrastructure from scratch. Even a floating regasification unit – a repurposed ship that can be towed into place – may involve 3-4 years of work.

The world’s new swing LNG producer

So is the Ukraine crisis going to be a shot in the arm for the US LNG industry? To a certain extent, there is already a US LNG export boom underway, with export capacity increasing from 4 billion cubic feet per day (about 41 billion cmpy) to around 14 billion between the start of 2019 and now.

“The investment thesis has certainly become much better than it was a few years ago, when JKM [Japan/Korea Marker] and TTF [Title Transfer Facility] were hovering around HH [Henry Hub] levels,” says Christopher Goncalves, managing director of BRG’s energy practice. “But this improvement took place in 2021, before the Ukraine crisis. Europe was being starved of gas, with lower volumes from Russia, and depleting storage volumes, driving prices much higher.”

Russia’s producers, thanks to earlier rounds of sanctions, had been suffering from reduced access to capital, though the pre-February sanctions regime had plenty of ways round. The Gazprom-sponsored Amur gas complex, a project explicitly designed to improve Russia’s access to Chinese markets, still attracted 13 western banks willing to write tickets of over $100 million each, albeit with cover from SACE and Euler Hermes. The $9.1 billion financing closed in December 2021.

The US, and to a lesser extent Qatar, are the cheapest sources of additional capacity, because Australian sources, much of them derived from coal-bed methane or distant offshore reserves, are more expensive. US shale gas producers can respond quickly to price signals, though operators and their lenders have proven to be more responsible at capital allocation than they were at the 2015 peak of the shale boom.

Permits in the bank - are banks lined up?

There is already a lot of additional US capacity ready to enter construction. Leading the pack of developers is Venture Global, which in August 2019 became the first fully greenfield export facility to close a construction financing, and in August 2021 partially refinanced the $5.8 billion construction bank debt package with a $2.5 billion bond issue.

Venture Global has three follow-up projects in preparation, including Plaquemines, which received Department of Energy authorisation for 35 billion cmpy of exports in 2019, Delta, which submitted a permit application in 2019, and CP2, whose application went in in 2021.

Energy Transfer has a full suite of permits for a 16.5 million tonnes per year (tpy) reconfiguration of its Lake Charles import terminal as an export facility. In 2020, Shell pulled out of the project, leaving Energy Transfer to develop the project on its own, probably at about two-thirds of its planned size.

Tellurian, a listed integrated gas-to-LNG developer, has suffered repeated delays to its flagship 11 million tpy Driftwood terminal in Louisiana. But the project has received all of its permits, and the developer says it is in the process of establishing an 8- to 10-strong bank group to provide about $7.2 billion in debt. “I don’t expect, given the urgency of the situation, that the financing for us will be very difficult,” said Charif Souki, Tellurian’s chairman, in a video statement posted shortly after the invasion.

Finally, Cheniere, the godfather of US LNG, is likely to come to market soon with a financing for stage 3 of its Corpus Christi facility, though it says at this stage only that the package will be “aligned with its capital investment parameters.” That phrase looks like code for maintaining the dividend, maintaining Cheniere’s BB rating and steering clear of refinancing shocks.

Other potential bottlenecks

The supply of permitted export projects, then, looks strong. The supply of tankers also looks strong, or at least capable of responding more quickly to price signals than the supply of terminals. Atlantic charter rates turned negative as recently as February, as cargoes switched from longer Asian routes to the shorter US-Europe leg. More generally, charter rates stand at $20,000 to $30,000 per day, though they still have the ability to spike at short notice.

The US LNG industry has also been successful in keeping a lid on construction costs. As BRG’s Goncalves notes, the first wave of brownfield export terminals (i.e., reconfigured import facilities) charged capacity fees of roughly $3-4 per million BTU, but thanks to innovations like Venture Global’s use of multiple smaller trains and healthy project competition, these fees have declined toward the low $2 per million BTU range. With the Henry Hub benchmark standing at around $4.70 per million BTU, and including 15% of that for transportation and fuel charges, that equates to a free on board price of just over $7.

There is also little sign that ESG concerns will derail new construction. Germany’s powerful Greens, faced with the alternatives of coal, nuclear, or Russian gas, are unlikely to put up spirited opposition to receiving terminal construction. The price spikes that have affected energy markets in the last 12 months are likely to convince policymakers that LNG is among the least bad transition options.

Banks have so far declined to apply stringent filters to LNG credits, though the market has not been tested since 2019 with a multi-billion construction bank project financing. JPMorgan Chase, Morgan Stanley, Mizuho Bank and Bank of America closed a $500 million early-stage construction facility for Venture Global’s Plaquemines in February 2021.

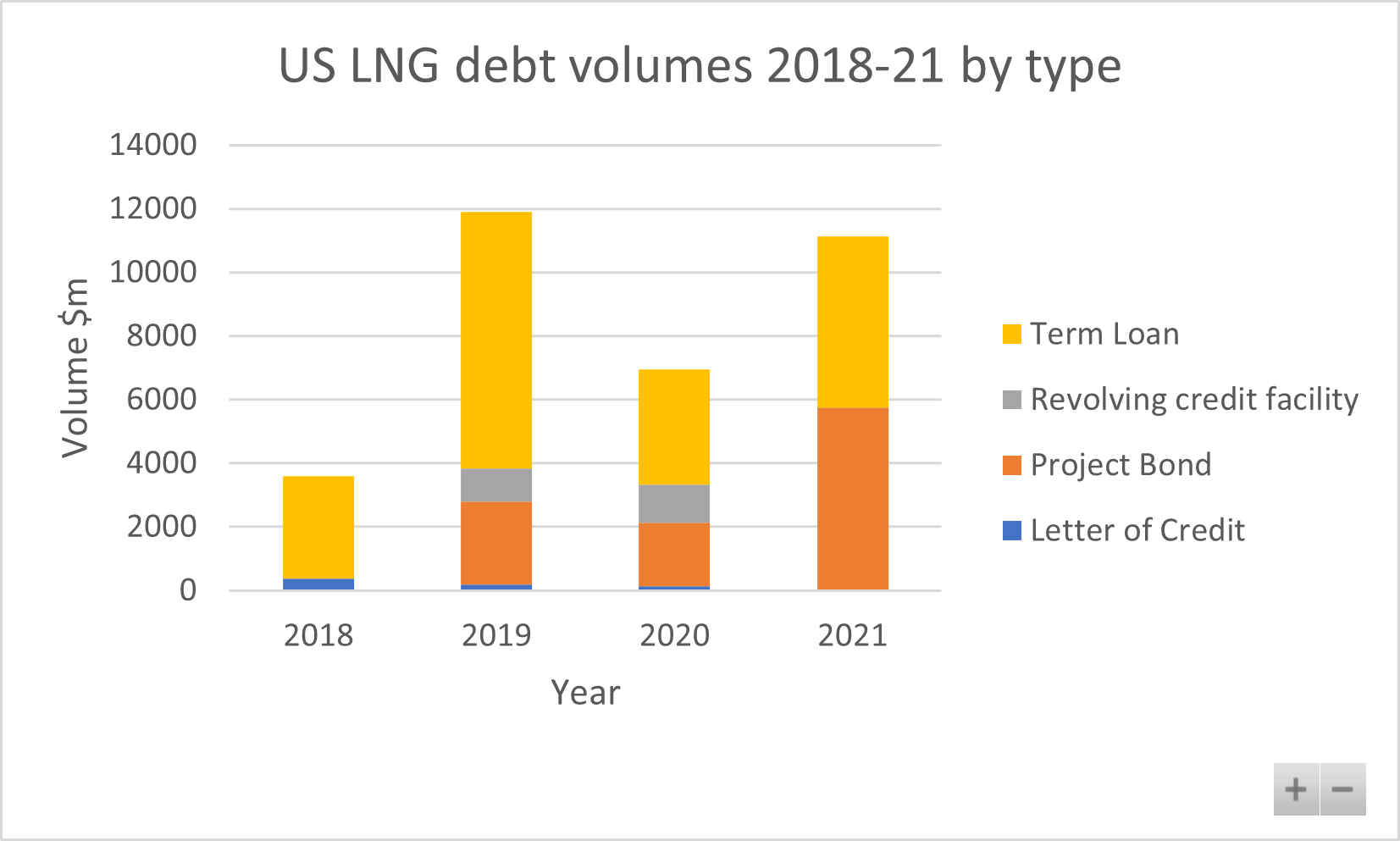

But the bond market has been an increasingly significant component of the project finance market for US LNG facilities, with bonds accounting for about $10 billion of the $33 billion in volumes since 2018, according to Proximo Playbook data. Those figures will include some double counting, because developers have tended to move quickly to refinance bank debt as soon as a project is far enough advanced in construction to support an attractive rating.

Among the highlights was the $2.337 billion bank and bond package that Michael Smith, the majority owner of the Freeport facility, closed to refinance his holdings in the project in November 2021. But Cheniere and Venture Global have both also closed bond refinancings in the last two years.

Source: Proximo Playbook

The Proximo perspective

US shale producers are anxious to exploit both the war and Europe’s concurrent turn away from coal to market volumes to European buyers. EQT (no relation to the fund manager of the same name) recently unveiled a campaign to “unleash” US LNG on coal-dependent consumers in Europe and Asia, promising to do to their generating fleets what its reserves in the Marcellus and Utica shales have done to those of Pennsylvania and Ohio.

No, a big limiting factor on the ability of US LNG developers to respond to Europe’s desire for independence from Russian gas is the same as it has been for the last two years: the general unwillingness of Europe’s utilities to sign long-term offtake contracts indexed to Henry Hub. With some notable exceptions - EDF and PGNiG are among Venture Global’s customers – European buyers have stood by while Asian buyers and aggregators have snapped up capacity under long-term contracts. With TTF levels at extremely elevated levels, some European utilities may now wish they had locked into Henry Hub several years ago.

Cheniere’s recent sale and purchase agreements include contracts with Sinochem, ENN and Foran, as well as Glencore. Tellurian’s customers include two commodities traders – Gunvor and Vitol – as well as Shell. “Until the war, European buyers very much had a short- to mid-term mindset,” notes BRG’s Goncalves. “And now it is hard to make a decision with gas prices where they are. In the 24 months we’ve seen some of the lowest and highest LNG prices that the market has ever seen. That level of volatility is not good for buyer confidence.”

Selected news articles from Proximo last week

PennDOT selects team for Major Bridge PPP

Bridging Pennsylvania Partners (BPP) has been selected by the Pennsylvania Department of Transportation (PennDOT) as the Apparent Best Value Proposer to administer the Major Bridge Public-Private Partnership (P3) initiative to repair or replace up to nine bridges across the state.

EUROPE

Sotra Link closes on ECA-backed facility

Sotra Link – a joint venture comprising Macquarie Capital (70%), SK ecoplant (20%) and Webuild (10%) – has reached financial close on the Sotra Connection toll road PPP project in Norway’s Vestland county.

ASIA-PACIFIC

Guam Ukudu Power project financing closed

Joint sponsors KEPCO and Korea East-West Power Co have closed on financing for their $562 million 198MW Ukudu dual-fuel combined cycle power project in Guam.

MIDDLE EAST & AFRICA

Details of lenders for REIPPP Round 5 projects emerge

Information has come to light regarding the banks lending to Bid Window 5 projects that form part of South Africa’s Renewable Energy Independent Power Producer Procurement (REIPPP) programme.

SOUTH AMERICA

Horizonte Minerals signs ECA-backed financing

Texas-listed nickel company Horizonte Minerals has signed a $346.2 million partially ECA-covered project financing to back its Araguaia ferronickel project in Brazil.

The Proximo Membership

Join a brand new community of project finance professionals getting unrivalled access to unique analysis, market data and a global portfolio of expert industry events in the energy and infrastructure space. Click here to find out more