On Your Radar for 2026: The Must-Watch Trends From 2025

These trends are already shaping what 2026 will look like. Our new video recap blends expert commentary from recent articles, key data snapshots, and highlights from our event panel discussions—giving you a clear view of what’s ahead and how to prepare.

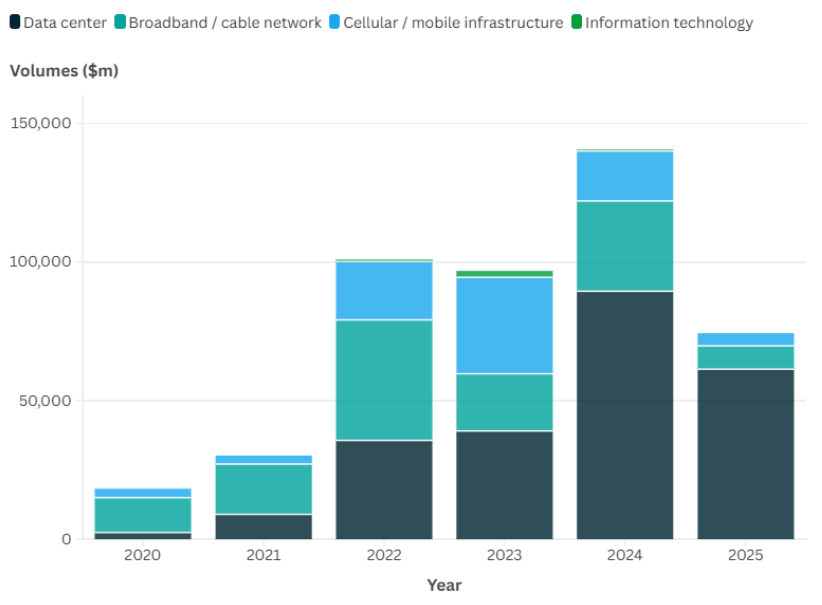

Trend 1: Data Centres Rule Everything (AI Project Finance)

AI demand is quickly making data centres the backbone of digital infrastructure finance, with projects increasingly judged on energy supply, environmental impact, and complexity of delivery.

Quick links & content:

By Q3 2025, surging AI demand has made data centres the dominant digital infrastructure asset in project finance.

Oracle nears $38bn funding for US AI data centres

Alternative Financing for Digital Infrastructure assets

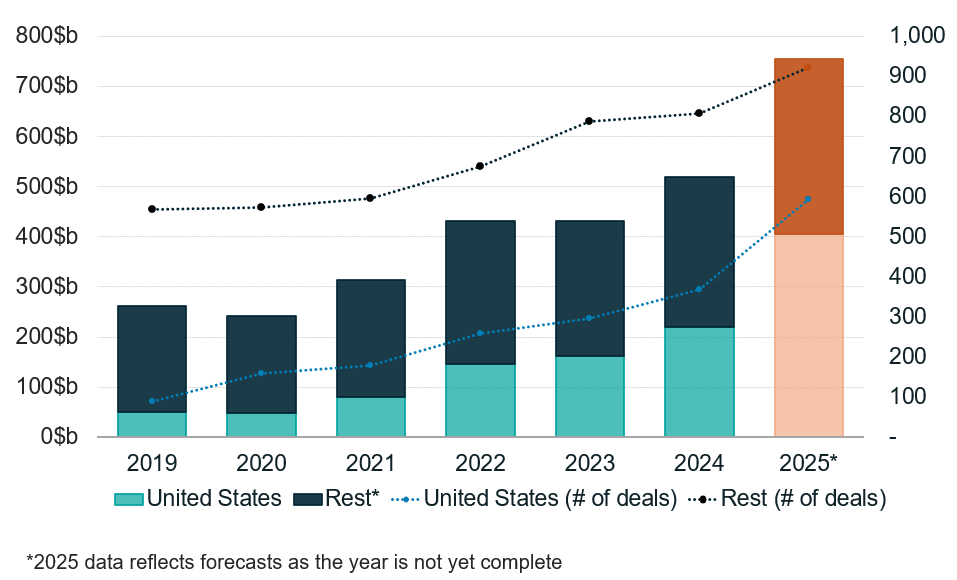

Trend 2: US Market & Infrastructure Dominance

The US remains the epicentre for major infrastructure and energy projects, attracting global capital despite rising protectionism and regulatory hurdles.

Quick links & content:

The Global project finance market is growing, and the US takes a growing share.

Could 2025 break records in global project finance?

The evolving US energy and infrastructure finance market

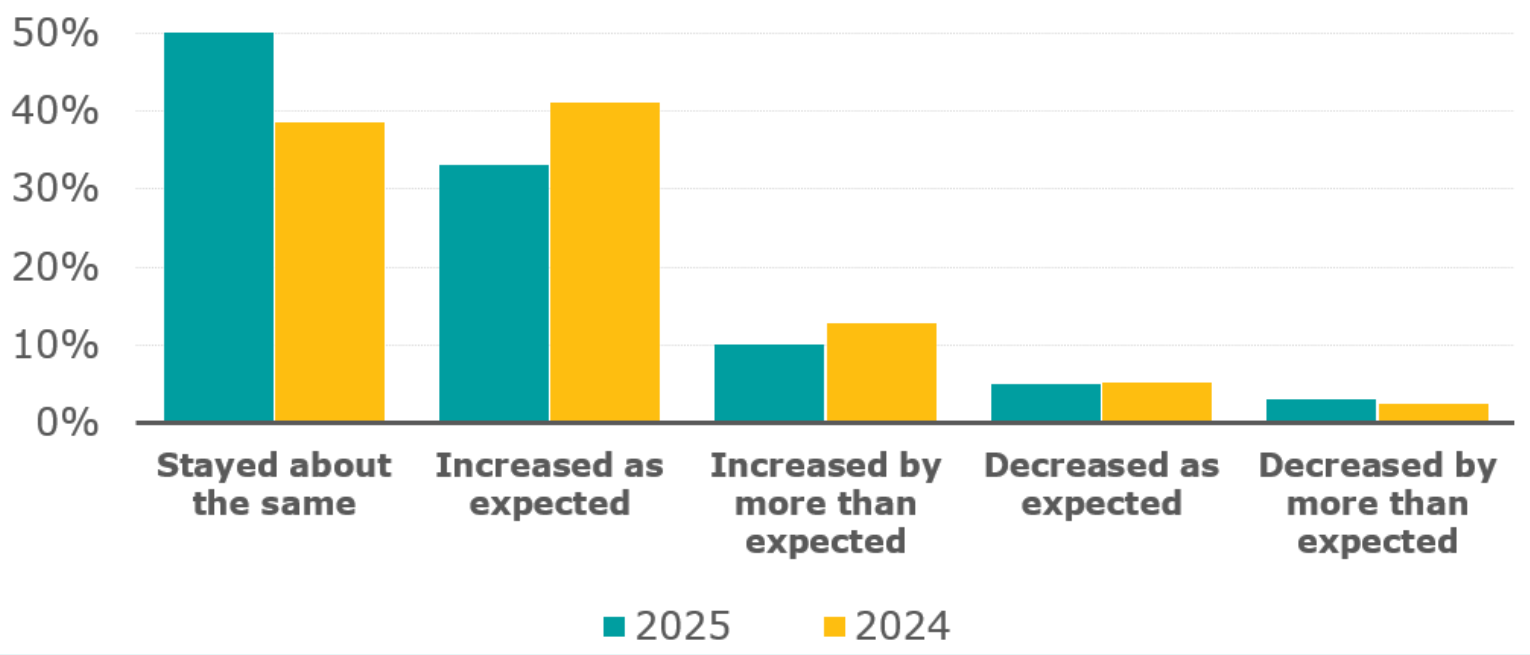

Trend 3: Supply Chain Resilience Worries

Ongoing disruptions and geopolitical stress keep supply chain resilience front-of-mind, driving deal scrutiny and prompting new strategies—but real certainty remains elusive.

Quick links & content:

The industry’s resilience is highlighted not only by the 50% who reported stable pricing over the past 12 months, but also by the fact that much of the price increases were anticipated.

The music's still playing in global project finance

Remapping America: The Capital Transition

These findings were curated through Exile Flow. Get access to further real-time deals data, recent news, articles, and event content for each trend with our secure AI tool.

Try it out for Trend 1 here

For even more trends and in-depth analysis, check out our Festive Trends podcast episode: