Funding challenges ahead for Latin America’s energy transition

Recent progress in Latin American renewable energy finance has been encouraging, but far from evenly spread. And regional debt markets may not be liquid enough to meet demand, according to Proximo’s data analysis.

Latin America is the third-largest region in the world for renewables finance activity, hosting nearly $45 billion in closed transactions over the 2018-2023 period. PV solar and onshore wind have dominated to date, but biomass, biogas and offshore wind are expected to see increases, according to Proximo data.

But higher inflation, signs of a reduction in the debt maturities available to developers, and the region’s plentiful oil and gas reserves all serve as headwinds to the region’s efforts to embrace the energy transition. And unlike several other regions. Latin America is still struggling to regain ground lost during the COVID-19 pandemic.

Renewable transaction and financial dynamic

Renewables transactions in the region peaked in 2019 at 90 closed deals with a cumulative value of $9.6 billion. But COVID first dampened financing activity, and then hampered the sector’s recovery, leading to higher capital costs, and prompting central banks to take drastic action to combat inflation. With Europe, and particularly the US, taking action to encourage renewables development, Latin America has struggled to maintain the interest of renewables investors.

But solar PV experienced something of a rebound in 2023, with $4.3 billion in closed transactions as of December 2023, and once all transactions are recorded the asset class could reach $5 billion, which would constitute a record year, and bring activity back to pre-pandemic levels. This recovery included transactions such as the financing for the 902MW Vista Alegre PV project, a $395 million AES transaction in the Dominican Republic, and the Solek PMGD solar portfolio in Central Chile.

Not all of this activity is being fuelled by private capital. Proximo data show that two Brazilian DFIs – BNDES and Banco do Nordeste do Brazil – appear in the region’s top five lenders, between them providing $7.5 billion in financing, or 17% of the total volumes recorded by Proximo in the 2018-2023 period. DFIs in general account for $13.3 billion in volumes, or 30% of all closed transactions. But export credit agencies (ECAs) accounted for only $2.1 billion in financing volumes over the same period.

Despite the heavy DFI presence, commercial bank debt is available for the right projects in the right markets. SMBC takes the number one spot among lenders in renewables financing, with $3.1 billion in volumes, followed by Santander, BNP Paribas, Natixis and MUFG, with the top five lenders accounting for $11.3 billion in volumes.

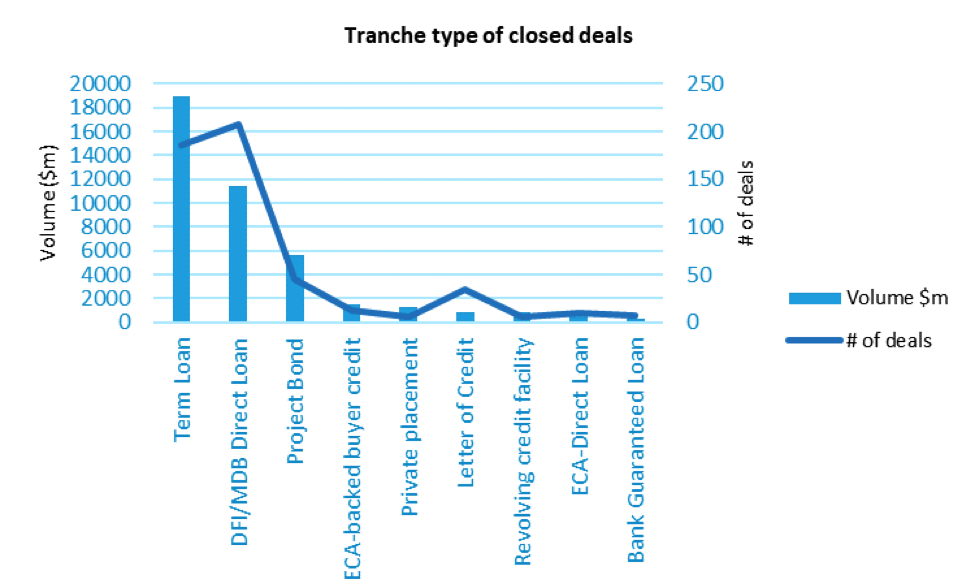

With commercial banks and DFIs dominating lending groups, term loans dominate the list of financial products used in renewable finance. For big-ticket greenfield projects, particularly in wind, ECAs have a role to play, and were prominent in the first four years covered by this analysis. But the use of private placements, particularly to refinance distributed generation portfolios in Chile, really took off in 2022 and 2023. But with bond and private placement investors pulling back from emerging markets as credit conditions tighten, direct loans from DFIs are increasing towards pre-pandemic levels, and will be key to financing greenfield projects in the more challenging jurisdictions.

Source: Proximo Intelligence

Latin America energy mix

Latin America has one of the cleanest electricity generation mixes of any world region. On average, the region produces 8.1% of global greenhouse gas emissions, a figure that is proportional to its population (World Bank, 2022).

From harnessing biofuels in Brazil, hydropower in various countries including Brazil, Venezuela, Mexico, Colombia, Argentina, and Paraguay, to tapping into high-quality solar and wind resources in Brazil, Mexico, Chile, and Argentina, the region exhibits a rich energy portfolio. Additionally, Latin America plays a pivotal role in producing essential minerals like copper and lithium in Chile, Peru, and Argentina, crucial components for clean energy technologies. Moreover, the region is endowed with substantial oil and natural gas resources in countries such as Venezuela, Brazil, Colombia, Argentina, and Mexico.

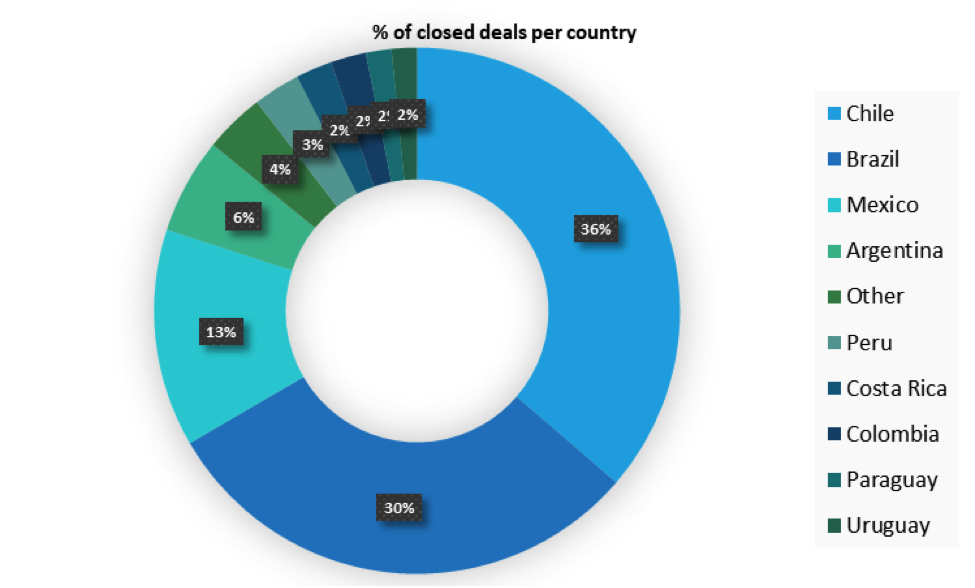

Renewable energy financing activity generally correlates with the size of the host country’s economy. So Chile, Brazil, Mexico, Argentina, and Peru take the lead in financing activity, accounting for 88% of closed deals. Chile alone accounts for 36% of closed deals, thanks in large part to the $9.4 billion in PV transitions it has hosted. Brazil has a more diverse mix of asset types, with $6.5 billion equivalent in onshore wind deals, $5.4 billion in PV solar, and $1.1 billion in biogas/biomass.

While financing activity in Mexico, Argentina, and Peru is more modest, these countries possess significant copper and lithium reserves, and may end up being bigger players in the energy transition through the supply chain than through decarbonising their own generation sector. Chile however, may end up being both. Of the region’s major economies, Colombia probably underperforms in terms of renewables finance activity, thanks to an electricity sector that combines a merchant power market with powerful publicly-owned utilities.

Source: Proximo Intelligence

Offshore wind has so far been notably absent from Latin American financing volumes. But this may change in the near future, especially in Brazil, which plans to grow the asset class up to 2035, thanks to projects that include Piaui, Ventos do Atlantico, and Dragao, which would together require an investment of $15 billion.

Latin America possesses the wind and solar resources to become a renewables powerhouse, but investments in the sector must double by 2030, and Latin America requires an annual clean energy investment of around $150 billion. According to Proximo’s data, the region has 125 major projects in the pipeline, valued at $66 billion, but debt capital needs to remain available on competitive terms.

Inflation struggles

But there are clear signs that the macroeconomic environment is not going to be supportive of these investment requirements. Latin America has long struggled to keep inflation under control, and governments remain under pressure to prove they can keep a lid on both public spending and prices. It is one reason why Chile, Peru and Colombia, for instance, have pioneered the use of off-balance sheet infrastructure financing techniques. Now higher inflation seems to be dampening the enthusiasm of lenders for long-dated infrastructure exposure.

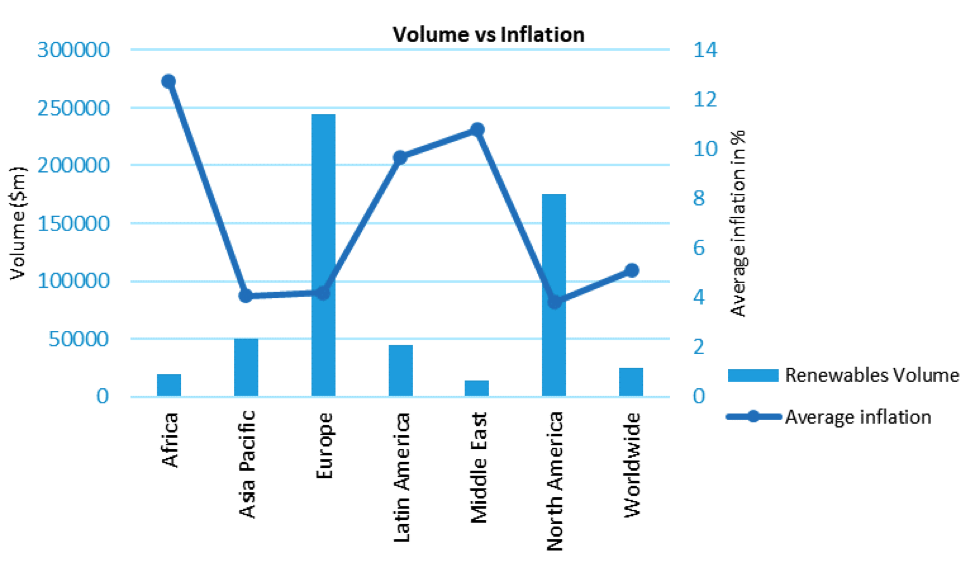

Average inflation in the region has been steadily increasing over the 2018-2023 period, reaching double figures in 2022 and 2023. Europe and North America prove that a low-inflation environment (no to mention generally being richer) can help in encouraging long-dated investments in renewables, though Asia-Pacific also enjoys low inflation – and low levels of renewables financing activity.

Source: Proximo, Statista

Source: Proximo, Statista

This increase in inflation has not so far harmed financing volumes in renewables, though there is likely to be a lag between agreeing component prices and closing a financing – the impact of 2022’s price rises might only be feeding through into developers’ financing models today.

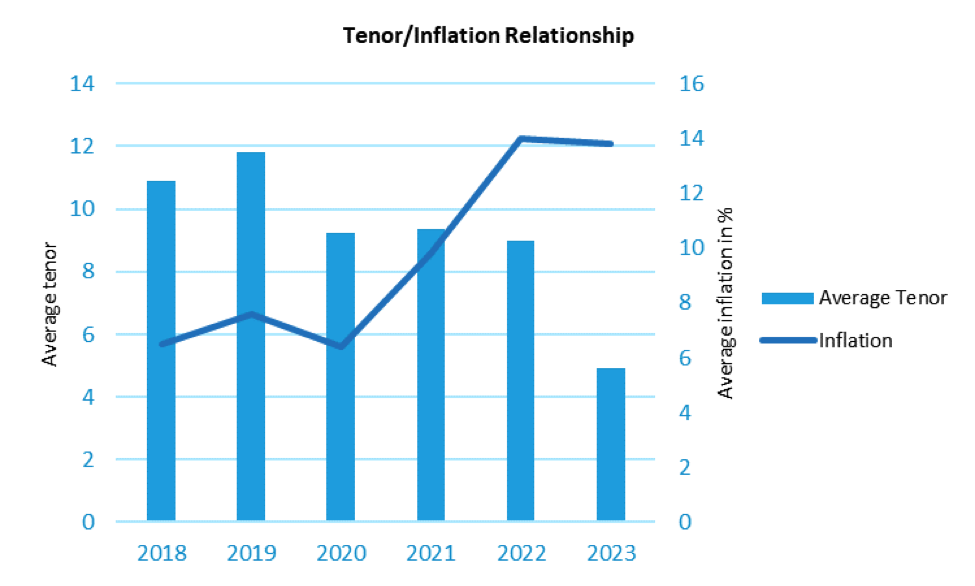

But the chart below points to a clear inverse relationship between inflation and debt maturities, with maturities shrinking as inflation creeps up. The average debt tenor has dropped from 12 years in the pre-pandemic period to five years in 2023. Shorter tenors place refinancing risk squarely on the shoulders of borrowers and sponsors, particularly when volatile debt markets make opportunistic refinancings harder. If inflation is expected to increase, investors and lenders may be hesitant to commit to long-term investments with fixed returns, as the real value of their returns will erode over time.

Source: Proximo, Statista

The Proximo perspective

Latin America is well placed to be both a source of demand for decarbonisation technologies and as a significant player in their supply chain. But with inflation increasing and tenors decreasing, Latin American mining projects might be better placed to capitalise on investor enthusiasm, given that mining projects generally require shorter-dated debt than renewables. At the very least, DFIs may become more essential as sources of long-dated debt, as Brazil’s continued dependence on domestic DFIs for renewables and infrastructure investment demonstrates.

The region’s most successful economies have combined a reputation for sound economic management with the development of infrastructure and energy investment programmes that encourage long-term, disciplined investment. As markets get more volatile, that sensible, balanced approach will get harder to sustain – but sustaining it will be key to meeting ambitious decarbonisation goals.

Current and future financing trends in Latin energy transition and renewables, along with a host of other infrastructure topics, will be under the focus at Proximo's Latin America 2024 conference, which is being held in Miami on February 27-28. To take a look at the agenda and speakers please click here.