JFK Terminal 1 partially-wrapped bond refinancing prices

The consortium developing JFK terminal 1 has priced a $2 billion tax-exempt bond issue to refinance bank debt used to fund the first phase of the project.

The consortium developing a new terminal 1 at New York’s John F. Kennedy International Airport has priced a $2 billion tax-exempt bond issue to refinance some of the bank debt that it has used to fund the first phase of the project. The financing combines both unwrapped series, and bonds that benefit from a AA/AA+/A1 (S&P/KBRA/Moody’s) wrap from Assured Guaranty. The bonds priced on 29 November, and are scheduled to close today.

The issuing conduit for the special facilities revenue bonds, which are green labelled but subject to the US alternative minimum tax, is the New York Transportation Development Corporation. The bookrunners for the bonds were Citigroup, Loop Capital Markets, BofA, Barclays, Blaylock Van, Cabrera, JP Morgan, Rice Financial Products, Siebert Williams Shank, SMBC Nikko and Stern Brothers. Bank of New York Mellon is trustee, while MUFG is intercreditor agent.

The issue comprises:

- $23 million in 2038 bonds with a nominal coupon of 5.5%, yielding 4.74%

- $12 million in 2039 5.5% bonds yielding 4.82%

- $9 million in 2040 5.5% bonds yielding 4.89%

- $12 million in 2041 5.5% bonds yielding 4.95%

- $26 million in 2042 5.5% bonds yielding 4.6%

- $38 million in 2043 5.5% bonds yielding 4.65%

- $35 million in 2044 5.5% bonds yielding 4.7%

- $218 million in 2049 5% bonds yielding 5.05%

- $543 million in 2054 6% bonds yielding 5.41%

- $601 million in 2060 5.375% bonds yielding 5.56%

- $484 million in 2060 5.125% bonds yielding 5.21%

The 2042, 2043, 2044, 2049 and lower-yielding 2060 bonds - $800 million in total - all carry a wrap from Assured Guaranty. The debt will be issued at a premium, and the bonds can be redeemed after 2031 at the option of the project without payment of a make-whole premium.

The issue is bringing in $2 billion in face value proceeds, $1.65 million in issue premium proceeds, and $183 million in proceeds from terminating some of the project’s interest rate swaps, a reflection of the upwards movement in base rates since the project’s original bank financing closed. Of those proceeds, $33 million goes towards transaction costs, $123 million goes towards additional development costs for the first phase of the project, and $2.02 billion goes towards paying down some of the $6.6 billion in bank debt that the sponsors closed in June 2022 to fund initial construction at the terminal.

The original debt package has a five-year tenor, and the sponsors say they plan to refinance it with a combination of bond, private placement and TIFIA debt in advance of the bank debt’s maturity. That debt package complemented $2.33 billion in equity from Ferrovial (49%), JLC Infrastructure (30%), Ullico (19%) and Carlyle (2%).

The project involves the construction of a new Terminal 1 at JFK, the major international airport for New York City, under a lease with the Port Authority of New York and New Jersey running to 2060. It is part of a wider redevelopment at JFK, which includes new terminals 1 and 6, the upgrades of terminals 4 and 8, and the demolition of terminals 2 and 3.

The new terminal one covers 1.8 million square feet and in its first phase involves the construction of 13 permanent wide-body gates and one temporary gate, which is scheduled for completion in June 2026. A B1 phase would involve another 2-4 gates, and a B2 phase 2-6 gates. A final phase C would involve the construction of another 4 gates on the site of the existing terminal 1. The existing terminal 1 is scheduled to continue in operation until it is demolished after phase A is complete.

The delivery group for the project comprises Ferrovial, Lehrer Cumming, SNC Lavalin, and McKissack & McKissack, while Tishman is design-build contractor, and Gensler is design lead. The sponsors’ financial advisers are Citi, HSBC and MUFG, while its legal advisers are Allen & Overy, Troutman Pepper, U Okoye and Gibson Dunn. The lenders’ advisers are Intech (insurance), Infrata (technical) and Milbank (legal), while the Port Authority’s legal advisers were Orrick and Skadden.

On the bond issue, the conduit’s legal advisers were Katten Muchin Rosenman and BurgherGray, the sponsors’ counsel wer Gibson Dunn and Bryant Rabbino, and the underwriter’s counsel were Nixon Peabody and Joseph Reid. Kestrel provided the bond’s green opinion.

The Proximo perspective

The financing highlights the fact that even in the absence of full privatisation for the US airport sector, there are substantial opportunities for private debt and equity providers to put capital to work in the sector. The Port Authority has been unusually receptive to PPP-like structures, and has used them to replace bridges and other airport infrastructure.

With travellers long complaining about the state of the region’s airports, the Port Authority and its host states have been under pressure to produce rapid improvements to the region’s aviation infrastructure. The result has been a complex process involving multiple projects and PPP consortiums, and massive amounts of interface risk.

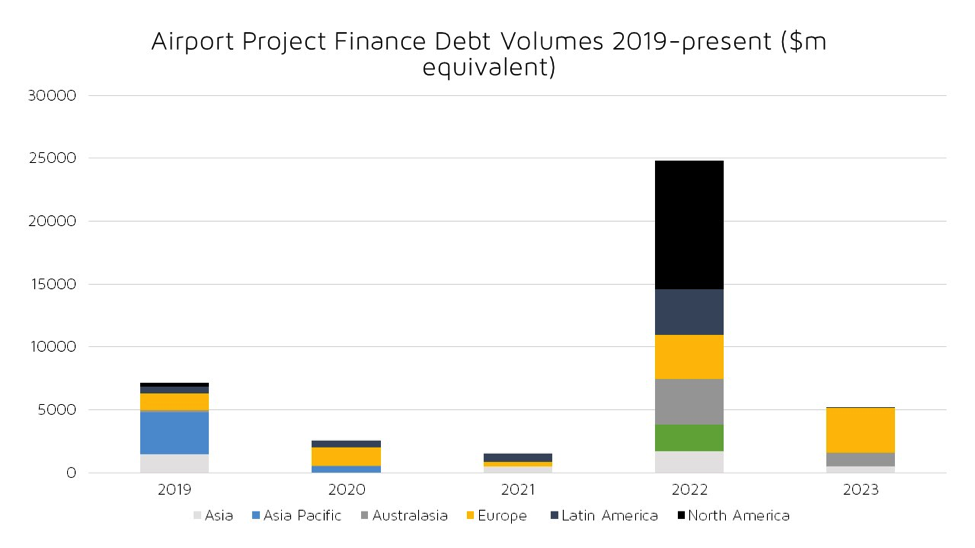

But the PPP structure has proved adaptable enough to the needs of both airlines and the private sector that it has attracted the attention of other US airport owners. It has also turned the US into a major centre for airport finance. So alongside regular brownfield issuers like Australia’s Sydney Airport and the UK’s Heathrow (which most recently also closed a £140 million Assured-wrapped long-term private placement in November), the financing for terminal 1 and terminal 6 at JFK accounted for a substantial chunk of 2022’s blockbuster volumes.

It’s tempting to see those deals as one-offs, the product of the political urgency attached to the redevelopment at JFK. But with a steady stream of refinancing activity as the terminals go through construction, and the prospects of decent-sized financings for subsequent phases, JFK could serve as a bank budget-boosting sub-sector in US project finance in its own right.

Source: Proximo Data