The ECB, not the EC, has the power to cure Europe’s wind woes

The European Commission (EC) plans to develop a dedicated guarantee mechanism for commercial banks' credit exposures to key wind industry suppliers in a bid to bolster the cost-challenged wind sector. Will it work?

The crisis in Europe’s wind industry seems, at last, to have hit home among the European Union’s policymakers. In late October the European Commission announced a European Wind Power Package, noting that the “EU wind sector is currently facing a unique mix of challenges that [have] slowed down the rate of progress.”

The commission’s statement first highlighted the good news: that the EU hosts 200GW of installed wind capacity, of which offshore accounts for 16GW (Brexit hurt that second number by a lot). But probably more important to the EU is the fact that wind still supports a substantial number of manufacturing jobs.

So the complaints of German offshore wind developers count for a little, and UK and US developers not at all. But the European Commission is generally worried that “the industry's manufacturing facilities are currently under-utilised due to slow deployment of wind energy and to the difficulties to accurately forecast demand for wind turbines in the EU.”

In the wake of the Ukraine conflict, Europe’s governments have learned that energy security sometimes does mean that decarbonisation will be slower than they hope. But Europe is still host to a large number of increasingly influential manufacturing operations. And those operations are the focus of the support package.

So the package includes promises of improved permitting but also measures to combat Chinese competition in the wind sector. The idea that European wind turbine manufacturing goes the way of its solar PV manufacturing sector – east – is a powerful focus. And it is looking at measures to improve coordination between governments and the skills base of the sector’s workers.

But the Commission’s only real mention of the inflation and interest rate environment is in terms of its effect on manufacturers. And its main concrete solution is to develop a “dedicated guarantee mechanism for commercial banks' credit exposures to key wind industry suppliers.” This is a solution firmly pitched at the balance sheets of suppliers rather than helping governments make wind development more attractive.

But the sad truth is that the interest rate environment is probably the key determinant of demand for wind turbines, given how important the cost of capital is to the lifetime cost of energy of wind (and solar for that matter). And here, the European institution with the most influence on deal flow is less the EC in Brussels and more the European Central Bank in Frankfurt.

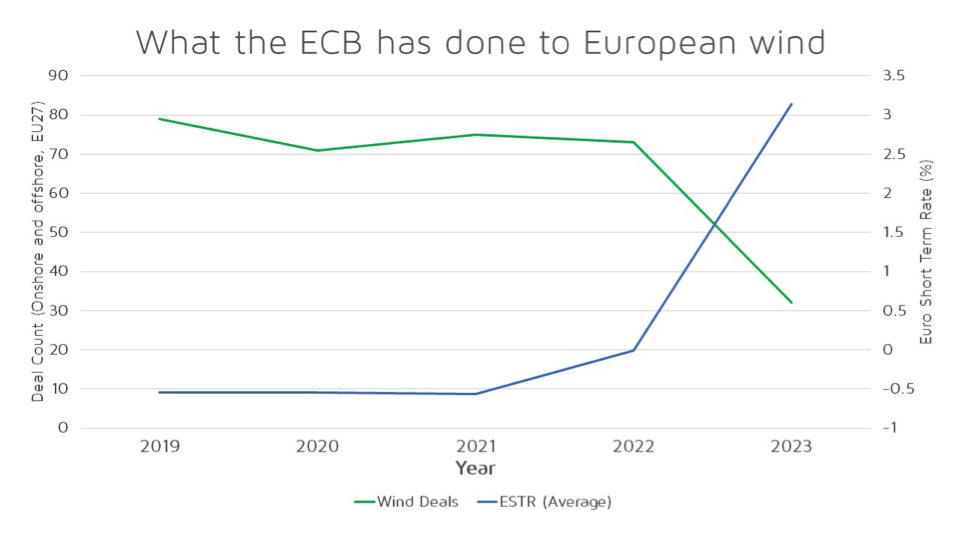

There is a remorseless connection between the recent increases in the European Short Term Rate and the decline in financing activity in European wind. Below, Proximo has plotted the (arithmetical) average ESTR for each year since 2019 against the number of transactions that have closed in onshore and offshore wind combined in each year. We have used transaction numbers rather than volumes because volumes have the potential to be distorted by large offshore deals or acquisitions.

Source: Proximo (Deal count), ECB (ESTR)

The Proximo Perspective

As rates began their creep up from negative levels in 2022, financing activity began to take a turn south. The relationship may not be directly causative, with other factors, not least commodity price inflation, coming into play. But the relationship is consistent with the complaints from sponsors captured in Proximo’s surveys, both online and at its events.

There are signs that the ECB is starting to soften its stance on interest rates. It held off on further rises at its 26 October 2023 meeting, and this has led to expectations that cuts might take place from early in 2024. More recently, however, ECB officials have been at pains to stress that their mission remains to combat inflation, and that cuts are only likely if there are clear signs that inflation is under control.

But until banks’ funding costs ease off, the European Commission’s measures are likely to serve as tinkers around the margins of the market rather than the infusion the market probably needs.