Lithium mining: Matching financing to friendshoring

What the collapse of a promising lithium acquisition says about the challenges in financing big-ticket mining assets in developed markets.

Lithium assets might be basking in the attention of investors, lenders and policymakers, but the normal challenges of financing and executing complex minerals projects still apply.

The collapse of chemical manufacturer Albemarle’s acquisition of lithium mine developer Liontown illustrates these challenges. Liontown’s Kathleen Valley prospect – potentially Australia’s fifth largest lithium mine – has lined up a strong group of manufacturers as offtakers, including Ford, Tesla and LG. And it reported positive discussions with a group of lenders led by export credit agencies Export Finance Australia (EFA), K-Sure and US Ex-Im.

As recently as the start of October, Albemarle spoke glowingly of the opportunities that buying Liontown would offer, including control of an upstream resource and what it called “significant net tax benefits”. At prices of $40 per kg, Albemarle said that the acquisition would be at a 3.5x Ebitda multiple, and make an internal rate of return three times its weighted average cost of capital.

But Albemarle, while it claimed it had the balance sheet capacity to support the A$3 per share (A$6.6 billion, or $4.2 billion) acquisition, said it was determined to maintain its own investment grade rating. On 15 October Albemarle abandoned the deal, citing “growing complexities associated with the proposed transaction”.

It is not yet clear what cropped up in late stage due diligence to give Albemarle cold feet, though cost inflation is hitting Kathleen Valley as hard as any other major project. In September 2023, Liontown had to admit to a 6% increase in project costs since January, to A$951 million.

The ECA financing package was not likely to meet the majority of that total, with the three agencies putting forward a joint conditional letter of support equivalent to about A$300 million. But Liontown was sitting on respectable amounts of cash, which stood at about $304.5 million as of the end of June 2023.

Liontown also has access to a A$300 million financing facility that it agreed with Ford, one of its offtakers, in June 2022. That facility, of which A$247.3 million had been drawn by mid-July, carries interest at 150bp over an un-hedged BBSW. The Australian interbank rate has crept up over 2023, but stands at a manageable 4.15%. Liontown has said in the past that, assuming the ECA package comes through, it probably only faces a A$150 million additional funding requirement.

The only major complication to the process came from Hancock Prospecting, the iron ore miner owned by Gina Rinehart, that acquired a 7.7% stake in Liontown by 11 September, and took its total holding to 19.9% by 11 October. That level is just below the threshold at which Hancock would have to make a takeover offer.

Australia’s mining analysts are suggesting that Hancock has effectively scared off Albemarle, and Hancock was certainly very sceptical about Liontown’s ability to control costs, noting that it had delayed the implementation of a direct shipping ore project that would have increased the project’s pre-completion revenues. Hancock also provided a helpful review of how much costs at Kathleen Valley had increased since its definitive feasibility study had been released, and noted how many risks had yet to be passed onto suppliers.

Hancock has yet to give any indication it wants to buy Liontown outright, and has yet to prove to its fellow shareholders that it can exert pressure on Kathleen Valley’s costs from the sidelines. It is rightfully proud of the $7.8 billion multi-sourced and ECA-led debt package that it closed in May 2014 for the Roy Hill iron ore mine. That financing, for an untested resource developed by a relative newcomer, still serves a benchmark for Australian mine finance.

But that was then. The lithium market exhibits different dynamics, and the interest rate and inflation market is very different. While the US, the world’s most promising electric vehicle market, is looking to domestic, nearby and friendly lithium suppliers, in that order, projects in high-cost locations will be particularly vulnerable to current macroeconomic conditions.

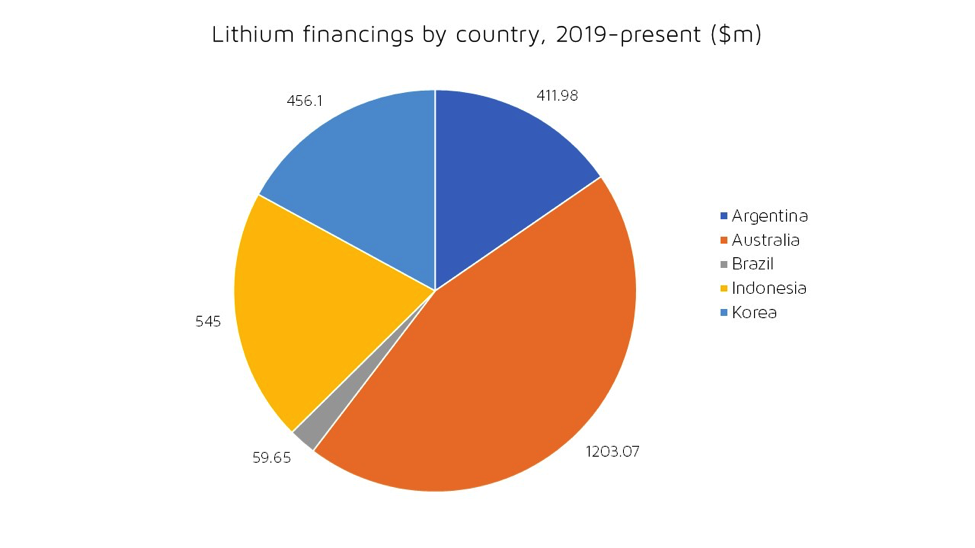

Lenders will need to get a handle on whether the benefits are worth the costs. Australia has accounted for the largest share of project financings for lithium assets – both upstream and midstream – since 2019, with Korea, Argentina and Indonesia close behind.

Source: Proximo Intelligence

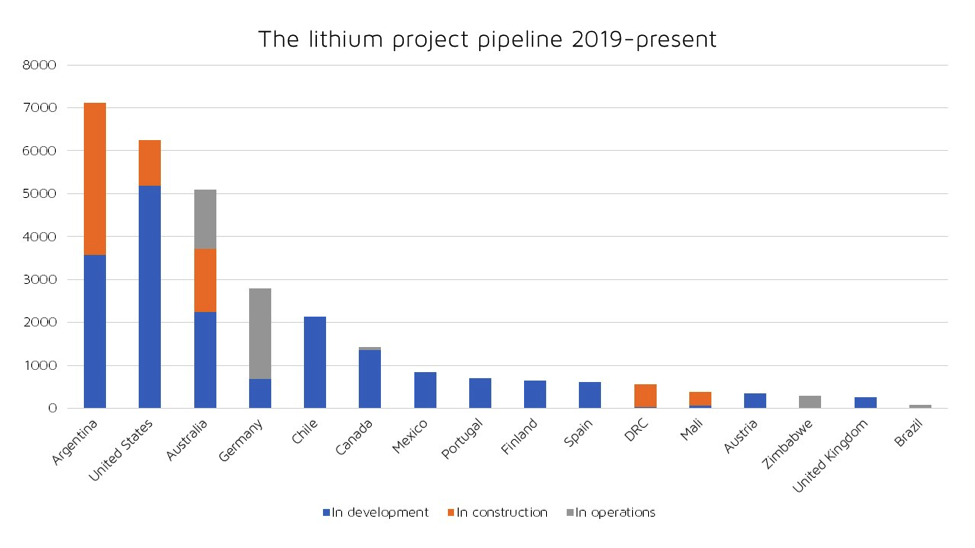

But a look at the pipeline of projects suggests that Australia’s dominance may be slipping. Proximo collects data on the mining projects most visible to the project finance lending community, as well as their stage of development.

Source: Proximo Intelligence

The Proximo perspective

This pipeline suggests that Australia, despite its recent success, might be a less significant source of near-term financing activity than Argentina – and particularly the United States. Very little of that US capacity is in construction, and the US has a much more modest recent history of mine financing than Australia.

But what it does have is a very liquid lender – the US Department of Energy. Ioneer, an Australian-listed but US-focused developer, is developing the Rhyolite Ridge resource in Nevada, which has a cost that was estimated in 2022 as at least $1 billion. Ioneer also counts Tesla as a customer, though unlike Liontown it has not persuaded any of its customers to pitch in with upfront financing. It probably doesn’t need to.

In January, the DoE’s Loan Program Office made a $700 million conditional loan guarantee commitment under the department’s Advanced Technology Vehicles Manufacturing initiative. The loan would have a term of ten years and carry what is effectively a small margin over the equivalent US Treasury. The proceeds would complement a $490 million equity commitment from Ioneer’s 50% joint venture partner Sibanye-Stillwater.

The DoE commitment has yet to turn into a signed financing. But rather like the Biden administration’s support for renewables development, the US has the firepower to change the rules of the game in project financing very rapidly.