Proximo Weekly: Will the next wave of fertiliser deals be greener than the last?

With the US holding a significant gas price advantage, the dynamics of traditional fertiliser production, particularly in Europe, are changing. But that change could also accelerate development of green ammonia in a bid to decouple from hydrocarbon feedstock prices - good news for project lenders that specialise in the niche.

For once, the UK was not alone in taking a bulldozer to its industrial heritage. In July, US-listed CF Industries said it would stop producing ammonia at its Billingham plant in the UK because high UK gas prices made it more sensible to import ammonia into the UK instead.

That it would continue to make ammonium nitrate fertiliser and nitric acid at Billingham from that imported ammonia was scant consolation. The plant is over 100 years old, and accounts for a meaningful amount of UK gas consumption, as well as a huge proportion of UK fertiliser demand. The decision was viewed as a sign that the UK is not serious about food security.

In this respect, however, the UK was simply taking its lead from Germany. In February 2023, BASF said it would close several production units at its Ludwigshafen plant, which is even more venerable, at around 110 years old. The BASF moves are more modest, and potentially temporary, however.

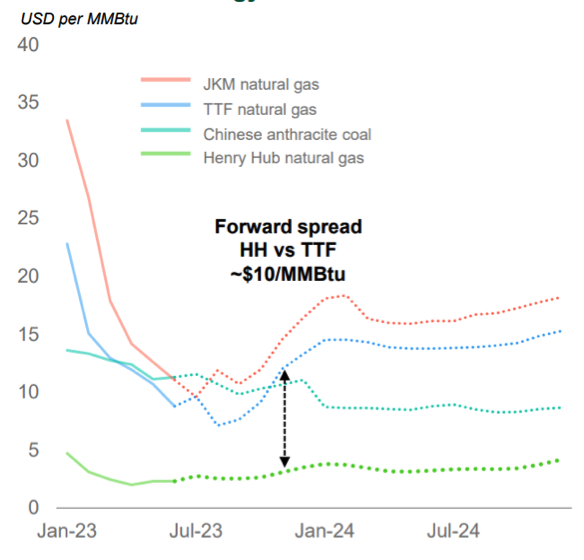

But the logic behind the closure is pretty remorseless. Even after the initial shocks to gas prices after Russia’s invasion of Ukraine, the US holds a persistent gas price advantage over Europe and Asia. Far better to turn it into ammonia in the US and import it into Europe to be turned into synthetic fertiliser than turn expensive gas into ammonia in Europe. CF, in announcing solid Q2 2023 results, illustrated the economics clearly.

Source: CF Industries

These closures recognise a trend that has been apparent in investment and financing trends for the last two decades – proximity to gas resources is key. The UK North Sea is no longer throwing off plentiful gas production, and Germany’s infrastructure for importing Russian gas is effectively stranded. Meanwhile producers in the US and the Gulf have been developing capacity to add value to their own reserves and benefit from that large Henry Hub discount.

It is 20 years since Oman Oil and two Indian fertiliser cooperatives, IFFCO and KRIBHCO, closed on the $969 million financing for a plant that now produces 3,500 tons per day of ammonia and 5,060 tons per day or urea. Given India’s improved demographic, economic and political standing in the intervening period, that pivot east looked sensible.

And it is ten years since OCI developed the first fertiliser project in the US Midwest in two decades – the Iowa Fertilizer plant. That deal was designed to exploit a combination of cheap shale gas-derived feedstock and cheap tax-exempt bond financing. It went badly over budget, and OCI had to step up with additional financial support. But current market conditions are highly supportive and OCI now says the plant is producing an Ebitda margin of 56%, compared to 47% for its peers elsewhere in the US.

The other high-profile recent fertiliser-related financing in the US was the 2019 Gulf Coast Ammonia debt package. That 1.3 million tons per year plant, sponsored by Mabanaft and Starwood Energy Group Global, used a strong set of offtake and feedstock contracts to raise $574 million of nine-year debt from eight banks at rumoured pricing of 225bp over Libor. That pricing is unlikely to be achievable in the current credit markets, no matter what the suite of contracts.

Since the start of 2019, just over $4.7 billion equivalent in project financings in fertiliser and adjacent projects have closed. Nearly half that total was for the Perdaman urea project in Western Australia, on which GIP wrote a $1.3 billion-equivalent equity cheque and a range of commercial and public lenders met the rest. Fertiliser project finance presents a limited set of data points, so Perdaman helps paint a maybe unfair picture of an asset class rapidly growing in popularity.

Some of the rest of that activity takes the form of potash and phosphorus projects, which generally fall under mining as a sector, and even combined are second to nitrogen-based fertilisers in their importance to global agriculture. They also usually sit in the shadow of other mined commodities, until a recent discovery of a large phosphate reserve in Norway excited a large quantity of positive commentary.

Not all of that enthusiasm was informed by the economics of extracting phosphate from the rocky and unforgiving landscape. Just ask Anglo American, which recently took a $1.7 billion writedown on its Woodsmith mine in North Yorkshire in the UK. Woodsmith will produce – at a great depth – polyhalite, which is as yet a niche fertiliser product, though one that Woodsmith’s initial developer, Sirius Minerals, said showed great promise.

The Proximo perspective

With ammonium nitrate fertiliser potentially competing with additional uses for ammonia – chief among them combustion – the outlook for ammonium demand is fairly strong. Hydrocarbons producers are rushing to rebrand ammonia as blue ammonia – though the century old Haber-Bosch process has always relied on natural gas as a feedstock and hydrogen as a step in the process. CF Industries has signed offtake agreements for “clean ammonia” with JERA and LOTTE, without going into specifics, though it is also developing a green ammonia project, whose hydrogen is derived entirely from electrolysis.

That last feature is probably the most exciting possibility for fertiliser producers and the niche group of project finance bankers who love them. Green ammonia is not yet cost competitive with blue ammonia, though there are huge amounts of enthusiasm for the technology, because it promises to uncouple feedstock prices from hydrocarbons prices, and essentially use solar or wind, which have fixed capital costs, as a feedstock. Given that nitrogen is extracted from the air for free, fertiliser prices, though not necessary volumes, start to look a lot less volatile.

Chief among the enthusiasts for green ammonia are Fortescue, the Australian iron ore miner turned hydrogen evangelist, and Morocco’s OCP. OCP control’s 70% of the world’s phosphorus reserves, but hopes to use ammonia derived from renewables to diversify its product mix. It has a $7 billion project in the works, and is already starting to invest in the solar capacity that might feed the project.

Selected news articles from Proximo last week

Maryland abandons Highway P3 scheme and pursues public funding

The state of Maryland will pursue public financing to address congestion issues on portions of its suburban Washington, DC, Interstate highways.

Northvolt raises $1.2bn for further expansion

Battery manufacturer Northvolt has raised $1.2 billion to finance plans for its further European and North American expansion.

ASIA-PACIFIC

India revises offshore wind strategy and targets first tender

India’s Ministry of New and Renewable Energy (MNRE) has published a revised strategy for offshore wind and plans its first tender in December.

Oman's Nama PWP plans 1GW solar tender

Nama Power & Water Procurement Company (Nama PWP) is planning to tender a 1GW solar IPP project for operation in 2029.

Peru tenders transmission concession package

Peru’s Agency for the Promotion of Private Investment (PROINVERSION) has announced the call for the tendering of a package of five transmission PPP projects.

The Proximo Intelligence subscription

Join a brand new community of project finance professionals getting unrivalled access to unique analysis, market data and a global portfolio of expert industry events in the energy and infrastructure space. Click here to find out more