Proximo Weekly: Inside the tax credit transfer window

The US government has released guidelines for how it will treat transferable tax credits. Will the new rules expand the tax equity market, or turn it upside down?

The Internal Revenue Service (IRS) and the Treasury Department have issued guidance on how they will treat the transfer of tax credits for renewables and other carbon reduction projects. Upon those guidelines hinge not just the future prospects for conventional renewables but the future of newer climate-friendly technologies like hydrogen and carbon capture.

The market’s working assumption was that making tax credits transferable would allow them to be claimed by a larger universe of tax-driven investors. As US law firm Akin put it, in a note on the new guidelines, “the simplicity of tax credit transferability should bring these investors off the sidelines.”

The US insistence that the nominal “owner” of an asset had to claim any tax credits was a bonanza for tax lawyers and the small number of financial institutions with the tax capacity and due diligence skills to assess renewables projects. The results of that insistence were predictable - frequent bottlenecks when the tax capacity of those institutions were constrained, as well as higher pricing on their tax equity than the risk justified.

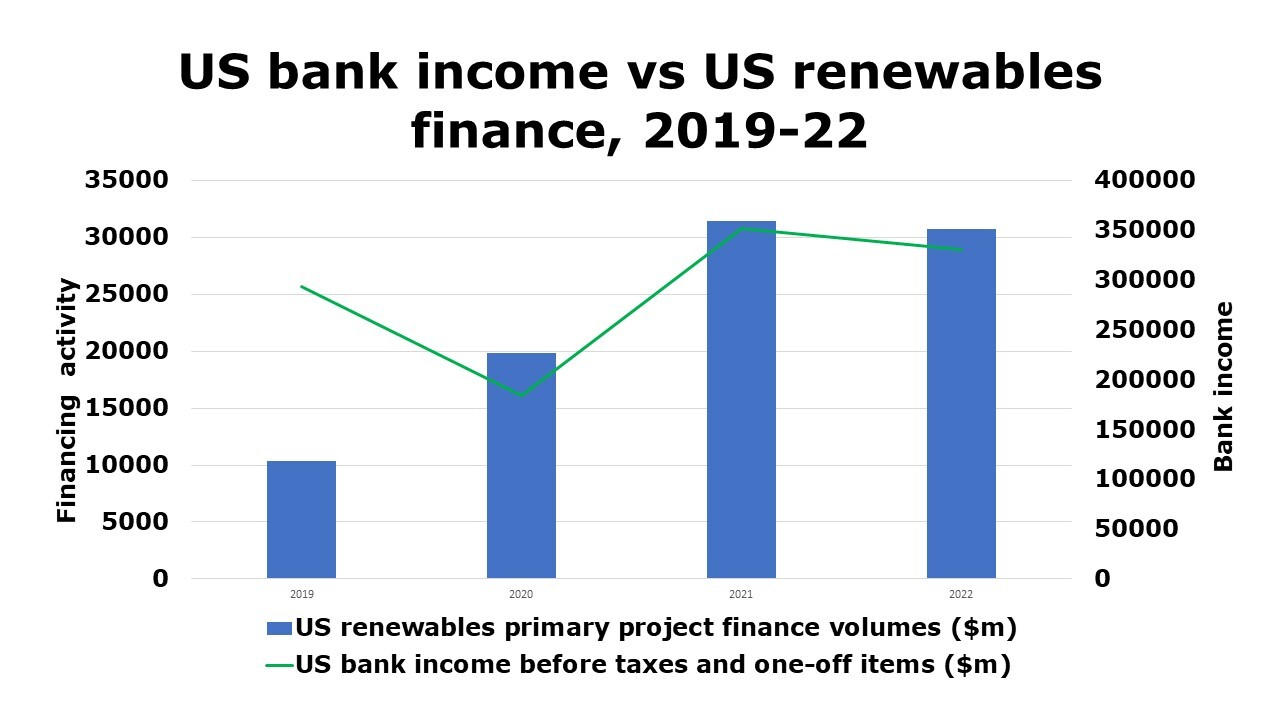

While US renewables remains a liquid and healthy project finance market, credit market wobbles may have explained why 2022 slightly underperformed 2021 in terms of new financing volumes. There looks like a weak correlation between bank income, as reported to the Federal Deposit Insurance Corporation, and US renewables financing activity, though several other factors might explain that correlation rather than just tax equity appetite.

Source: Proximo Intelligence data, FDIC data

If the US absolutely refused to do away with using tax credits to support renewables, then broadening their investor base was a solid second-best. The 2022 Inflation Reduction Act allows qualifying projects to make an election under section 6418 of the tax code to transfer their credit. They must also register on an IRS-managed portal – and that portal is not yet in operation. Sellers will have to wait to be registered before they can start transferring credits.

The IRS and Treasury generally erred on the generous side when interpreting their mandate. For instance, while each tax credit can only be sold once, brokers will be allowed to help market and syndicate down credits as long as they do not become an intermediary buyer. Forward purchases of credits are allowed, though cash can only change hands for credits in the year that the credits are generated. There will also be a lag in receipts, so bridge or liquidity structures will be an important part of future financing structures.

The IRA hugely boosted the number of assets that will be eligible, and also included bonus credits for projects that meet additional eligibility criteria. The guidelines say that bonus and base credits cannot be sold separately, and sales must be for pro-rata shares of each type of credit. This may have been designed to protect investors. The bonus credits may have a higher likelihood of recapture, and the risk of credits being recaptured lies with the buyer – though sellers can offer indemnification.

Still the potential market is huge. Another US firm, McGuireWoods, notes “Eligible taxpayers under this statute include any entity that is subject to US tax.” It looks like developers can say goodbye to the US tax equity oligopoly. But US lenders look like making decent fee income from low-risk tax credit liquidity facilities. Perhaps, to quote one US developer shortly after the IRA passed, Christmas really did come for everybody.

Selected news articles from Proximo last week

Atlantic Shores and Empire Wind to launch to bank market by year-end

The Atlantic Shores and Empire Wind US offshore wind projects could launch to the bank market by year-end or in early 2024, according to a senior financier actively involved in the financing of US offshore wind projects.

OXG Glasfaser committed debt details

More details have emerged on the committed non-recourse financing of the FibreCo/OXG Glasfaser FTTH network project in Germany which kicked off syndication March.

Kalgoorlie gets A$3.1bn price-tag and potential partners

Ardea Resources has signed a non-binding MoU with a consortium of Japanese companies to potentially develop the A$3.1 billion ($2.069 billion) Kalgoorlie nickel project Goongarrie Hub, in Western Australia.

Pensana updates financing and development plans for Longonjo mine

Pensana has revised its financing and development strategy which will see the Longonjo operation fully funded into production.

SOUTH AMERICA

Peru to award $2bn of projects in H2 2023

Peru’s Private Investment Promotion Agency (PROINVERSION) is planning to award 12 projects worth $2 billion in the second half of 2023.

The Proximo Intelligence subscription

Join our community of project finance professionals to get unrivalled access to unique analysis, market data and a global portfolio of expert industry events in the energy and infrastructure space. Click here to find out more