Proximo Weekly: SVB and US renewables lenders’ maturity struggles

The collapse of Silicon Valley Bank highlights some of the shortcomings of the US renewables project finance market. What does the Proximo Intelligence data say about SVB's successes and challenges in US power?

It has been nearly 15 years since the last rash of US bank failures, the group of fast-growing mortgage lenders that fell like dominoes in the years around 2008. Now, the spike in US interest rates, coupled with softness in the tech sector, has claimed another major lender.

Silicon Valley Bank, the 16th-largest US bank by assets, was taken over by the US Federal Deposit Insurance Corporation (FDIC) on 10 March after its depositors started to withdraw their deposits. The US Department of the Treasury promised to protect all of the bank’s depositors on 12 March and on 13 March, the UK government brokered the sale of Silicon Valley Bank’s UK operations to HSBC.

It was, suggested one observer, the first bank collapse that originated on Slack, a reference to the messaging platform in use at many start-ups. Nervous tech companies, which parked their cash in disproportionate quantities at SVB, took one look at the nasty mark-to-market losses that the bank was recording on its sales of safe, but underwater bond holdings, and collectively decided to pull their deposits. The FDIC stepped in after the ensuing bank run.

The debate over the wisdom of making large uninsured depositors whole will play out in the coming months, and is likely to follow similar lines to the discussions that took place after the 2008-9 bailouts. Shouldn’t large depositors be performing proper credit analysis and practising diversification when parking the money they raise from their venture capitalist owners?

The failure of SVB was not especially complex. Banks are in the business of taking short-term deposits and using them to make long-term, illiquid loans. Because those loans are not callable, but deposits are, banks use funding mechanisms that include an element of long-term, non-callable capital, whether from bonds or equity.

SVB’s main business model, providing banking services to tech companies and investing deposits in liquid but interest rate-sensitive securities, proved to be defective. But SVB’s fall also says something about the evolution of debt markets in the US power and renewables sector.

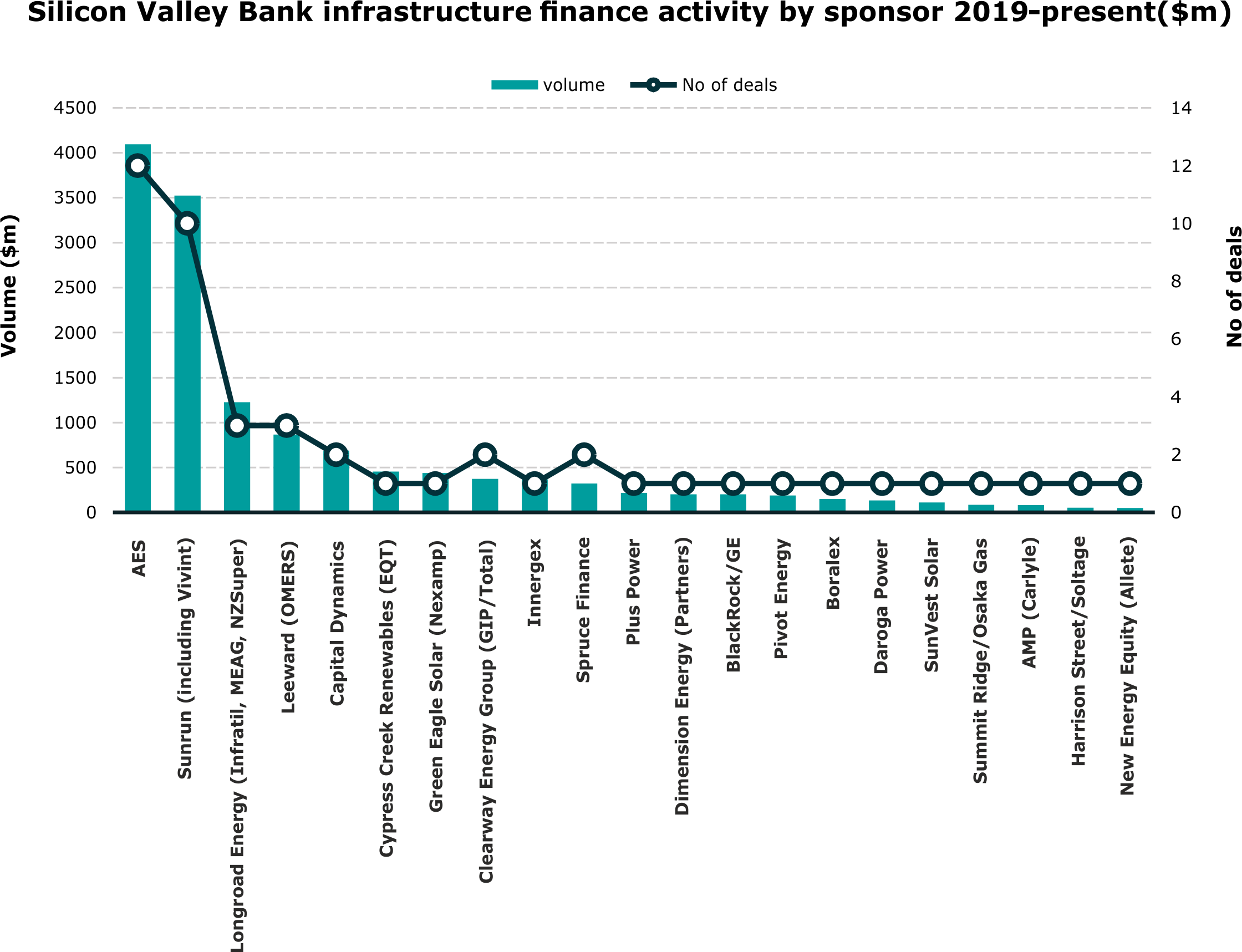

Proximo has taken a look at the data it holds about SVB’s activities over the last several years. It has captured 50 transactions for both the bank and its affiliate SVB Capital from 2019 on - both corporate and project finance and in power and renewables in the US - for a total lending volume of about $2.975 billion, or very roughly equivalent to 1% of the bank’s assets, though Proximo’s data does not record whether those amounts are retained or insured or otherwise distributed or refinanced. Some reports have suggested that SVB made about $5 billion in project finance commitments over its entire period of activity in the market.

Those volumes are equivalent to a 1.7% market share in North American power and renewables, or a league table placing of 16th. SVB is one of six US lenders active in the market, alongside KeyBank (2nd), Cobank (8th), Bank of America (17th), Morgan Stanley (18th), and Wells Fargo (20th). About 86% of SVB’s commitments were to pure PV solar projects, with another 3.5% to storage and 8.5% to mixed renewables portfolios.

US lenders have long struggled to match the tenors that European, Asian, and even Canadian banks can offer in project finance and for long-lived infrastructure assets, tenor is key. Cobank has a long history of US project finance lending and enjoys a highly stable and cheap funding base as an agricultural specialist. BofA, Morgan Stanley, and Wells Fargo all lend alongside their tax equity or investment banking operations. KeyBank is a solitary, and impressive, exception to the rule.

SVB entered the project finance market in large part thanks to other banking relationships. Over its 15-year history in the market, the sources of equity for renewables shifted from its natural focus - venture capitalists - to infrastructure funds. Its developer client base would once have been called cleantech, but those developers have now either listed themselves or become portfolio companies for large financial sponsors or institutional investors.

Along the way it carved out a strong market niche in areas like battery storage, community energy, and distributed solar. These are areas where speed and willingness to get comfortable with emerging technologies and business models were probably more important than writing $100 million seven-year tickets at sub-200bp pricing.

Another factor that helped US lenders maintain a presence in US renewables lending was the growth in sponsor demand for short-term, flexible, revolving debt - in particular warehouse facilities. These warehouse facilities have evolved under the direction of financial sponsors from smaller ancillary facilities that helped developers make progress payments on equipment with long lead times to an important means of constructing large utility-scale solar projects.

A look at SVB’s largest clients bears this out:

Source: Proximo Intelligence

SVB’s two largest clients are SunRun, a residential and distributed solar developer that closed a $1.8 billion warehouse facility in October 2021, and AES, the global IPP that has developed a model that involves using warehouse facilities to fund construction and a frictionless capital markets take-out using a master indenture structure.

These business models are very suited to accessing the truncated maturities that are most popular in the US bank market. They also give banks a chance to offer sponsors ancillary services, including capital markets, corporate banking, and tax equity. SVB was not the only lender to do the work on renewables resources, tax equity structures, early stage technology, and loan guarantees, or always the first, but it was an important part of the lending ecosystem for renewables sponsors.

The more modern renewables construction portfolio structures are more dependent on replenishable revolving debt facilities than older term loan-based financings. As such, they do expose sponsors to funding risk - that a lender will not be around to fund on its commitment.

SVB is unlikely to present systemic levels of risk to the US project finance market, though Proximo wishes SVB’s talented project finance group all the best in the coming months. SVB’s strongly performing loan book - if carved out from its ravaged bond holdings - is likely to attract substantial interest from investors, as the FDIC works to resolve the hole in its books. Its project finance book might even be combined with its origination platform and sold to a bank or non-bank player looking to build a presence in the IRA-supercharged US renewables market.

But SVB’s fall highlights the challenges that maturity mismatches continue to pose for financing long-lived infrastructure assets in the US. Structures have generally evolved to manage these issues, but with the Inflation Reduction Act pointing to some significant tweaks in the way that US renewables projects are financed, sponsors and lenders will need to be alive to the potential vulnerabilities in new structures.

Selected news articles from Proximo last week

Navisun closes $235m for solar projects

Navisun has secured up to $235 million in debt financing through two separate facilities to scale its business and execute its project pipeline of solar projects.

Vauban closes Boreal senior debt refinancing

Vauban Infrastructure Partners has closed a NOK3.2 billion ($295 million) senior debt refinancing transaction for Boreal Holding AS.

Laos cross-border wind financing priced

Sponsors of the 600MW Monsoon onshore wind power project in Laos — Thailand-based Impact Electrons Siam (IES), BCPG, STP&I, Mitsubishi, ACEN and SMP Consultation Sole — signed a $692.55 million heavily DFI-backed financing to fund the scheme earlier this month.

Details of debt relief for Eskom announced

The South African government has released details of debt relief to be offered to state-owned national utility Eskom over the next three years.

SOUTH AMERICA

Brazilian street light PPP tenders due

The call for proposals for the second round of street lighting PPP projects across Brazil are expected imminently, with the IFC and Brazilian state-owned bank Caixa Economica Federal (CAIXA) providing advisory to the schemes.

The Proximo Intelligence subscription

Join our community of project finance professionals to get unrivalled access to unique analysis, market data and a global portfolio of expert industry events in the energy and infrastructure space. Click here to find out more