Proximo Weekly: The changing face of Latin American merchant renewables

Can sponsors’ and lenders’ tolerance of Latin American renewables spot price and volume risk survive contact with market realities?

Despite recent dislocations in credit markets, and a period of political and regulatory instability in Latin America’s largest markets, the region’s renewables developers and lenders appear to be comfortable with some degree of merchant risk. Panelists at the Proximo Latin America 2023: Energy, Infrastructure & Development Finance event in Miami last week seemed much more unnerved about political risk than market risk.

Heightened tolerance of revenue risk is one of the surest signs of a top in credit market conditions. Whether spot market risk in the US power market in the years leading up to 2001, or usage risk in the global toll roads sector in the re-2008 period, this tolerance is as much of a feature of a credit market bubble as depressed debt pricing.

But measuring heightened merchant risk has become harder. It is now very unlikely that commercial banks will provide non-recourse financing for the development of a greenfield and completely merchant gas-fired power plant. That stance is probably as much about nervousness about the carbon footprint of gas as memories of 2001. But banks in the US will frequently finance brownfield gas-fired assets, and even some new projects, with appropriate hedging mechanisms in place.

In renewables, which was far from mainstream in 2001, merchant risk has evolved differently. Until recently, lenders did not have to worry about fuel price risk, and usually did not have to worry about dispatch risk. With lenders primarily focusing on production risk (i.e. whether sufficient sun and wind is available), their tolerance of price risk was initially limited.

As renewables finance evolved in the US, gas price hedges started to support renewables development. But with the rise of corporate power purchase agreements and other offtakers, sponsors and developers found these offtakers much more congenial. Corporate offtakes have been a way for developers to create a beachhead in evolving power markets in Mexico and Brazil, but are still far from mainstream.

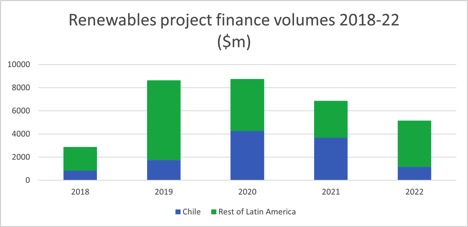

Latin America has experienced one merchant power boom. In the years leading up to 2015, the Chilean power market witnessed a surge in merchant-based renewables financing. With the country’s power sector dependent on imported coal and gas, and transmission networks highly constrained, banks – and particularly DFIs – were generally comfortable with merchant risk. The interconnection of the northern SING and central SIC grids, combined with a fall in oil & gas prices, led to a wave of distress in the sector.

So now, Latin developers are looking at which of the two main quasi-merchant tweaks will offer the best returns. Sponsors are either asking lenders to look at taking on spot market exposure late in the life of a financing - the merchant tail concept - or trying to keep some portion of their capacity out of contract to allow them boost returns on the merchant capacity if market conditions are promising.

The structures that have evolved in Chile since 2018 - particularly the wildly successful PMGD scheme – have tended to ask lenders to take on something that looks like a merchant tail. What one debt investor calls a “stealth merchant” risk profile. PMGD is designed to support the construction of small distributed solar assets, but it has been trivially easy for sponsors to aggregate and finance them as large portfolios.

With PMGD, the “stabilised” prices that generators receive are set through a regulatory process that looks at how power prices, both spot and contracted, will evolve. With Chile still experiencing the aftermath of the 2020 price spikes, and gas- and coal-fired capacity retiring at a reasonable clip, current prices look promising. But with more cheap renewables coming online, it is likely that further down the line prices will fall.

Source: Proximo Intelligence data

Source: Proximo Intelligence data

Still, in general PMGD portfolio financings are getting larger and more widely distributed. Sponsors at Proximo’s Miami event would joke that assets would be described as semi-merchant or semi-contracted depending on the audience being addressed.

There’s also the possibility outside of the PMGD scheme that sponsors will be able to spin keeping some of their capacity uncontracted as a credit positive. It is unlikely that the proportion will reach the 50% that has been seen on some recent European offshore projects, or create flexible amortisation structures to get lenders comfortable with merchant, as recently appeared on Portugal’s Finerge.

But the potential increased use of storage – and growth in sponsors offering firm power contracts, mean that a small merchant buffer might allow them to ride out any connection or dispatch issues without having to go out to the spot market and make up any shortfall. According to one panellist, the blackouts in Texas in 2021 have concentrated sponsors’ and lenders’ minds on dispatch risk.

The current boom is not likely to lead to as hard a landing as 2015 in Chile. In fact, given that there will at least be small amounts of amortisation under the best PMGD conditions, and that debt can be sized to attach lower gearing to uncontracted portions, any reckoning could be outside the time horizon of a lot of commercial bankers, if not some institutional lenders. So on current evidence, renewables remain a major bright spot in Latin America’s project finance market.

Selected news articles from Proximo last week

NORTH AMERICA

Qilak LNG targets Asia with $5bn project to compete with Russia

Qilak LNG plans to invest $5 billion in a proposed LNG facility in Alaska's North Slope to compete with Russia's Yamal project for Asian customers towards the end of this decade, its chief executive said.

EUROPE

Community Fibre syndication ongoing

The syndication of the £985 million financing of Community Fibre's UK FTTH network is ongoing, according to a source close to the deal.

ASIA-PACIFIC

PLN out to banks for transition loan

Indonesian state-owned electric utility PLN is out to banks for a $500 million NEXI-backed loan to finance energy transition and renewal projects in the Southeast Asian country.

MIDDLE EAST & AFRICA

More details on Ras Ghareb wind financing

Sponsors of the 500MW Ras Ghareb wind farm in Egypt’s Gulf of Suez — comprising Engie (35%), Toyota Tsusho & Eurus Energy (40%), and Orascom Construction (25%) — signed on a $501 million loan to back the scheme on 6 March.

SOUTH AMERICA

Sul de Minas Gerais highway concessionaire to begin operations

The Brazilian state of Minas Gerais has authorised a consortium to take over the concession contract for the Sul de Minas highway concession.

The Proximo Intelligence subscription

Join our community of project finance professionals to get unrivalled access to unique analysis, market data and a global portfolio of expert industry events in the energy and infrastructure space. Click here to find out more