Proximo Weekly: Adani and the weaknesses of Indian infrastructure finance

Listed equity and infrastructure assets often make strange bedfellows. The latest demonstration comes from the clutch of Indian infrastructure corporates headed by Gautam Adani and his family.

The seven listed entities carrying the Adani name have lost a collective $110 billion in value since a US short seller, Hindenburg Research, alleged irregularities with Adani’s governance, accounting and compliance processes in late January. Adani supplied a lengthy rebuttal to the allegations, but the damage to its fundraising prowess has been immense.

Adani Enterprises cancelled a $2.5 billion equity issue on 1 February, despite reaching its required subscription level, saying that a 30% decline in Enterprises’ share price meant that closing on the sale would not have been “morally correct”. Gautam Adani’s net worth has fallen from an estimated $120 billion to nearer $60 billion.

Adani Ports and Special Economic Zone (APSEZ) has had to promise to pay down INR50 billion ($605 million) in corporate debt, while Gautam Adani and family have paid down INR92.5 billion in loans that used the shares of listed Adani companies as collateral. At least two international banks have stopped accepting Adani group shares as collateral for margin loans.

At the very least, the episode is likely to hamper the breakneck expansion of the Adani group of companies. Regular access to debt and equity capital markets was a key factor in allowing Adani companies to recycle debt and equity commitments. And India’s debt markets remain imperfect vehicles for efficiently and robustly financing long-dated infrastructure assets.

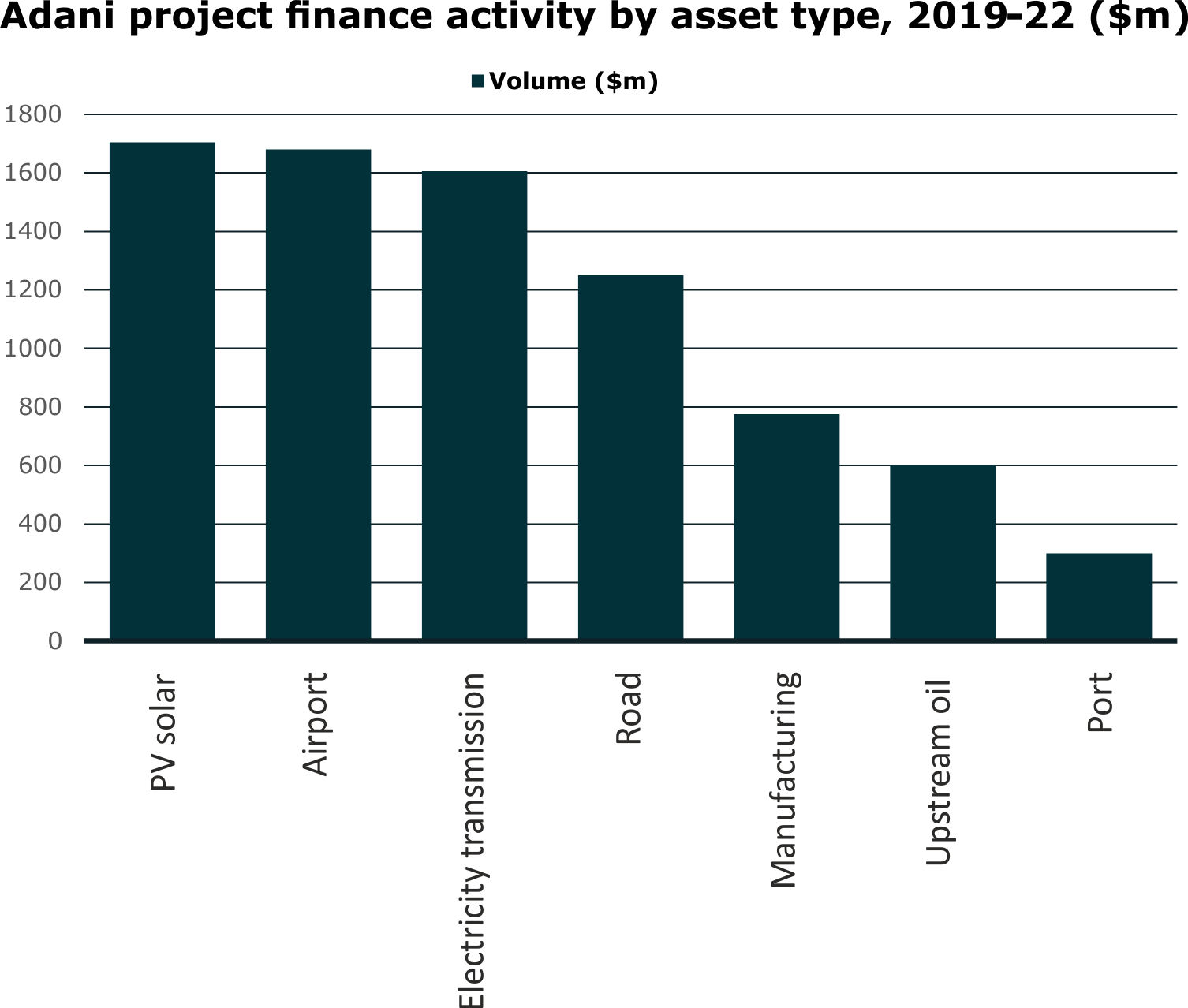

Adani’s own project finance record over the past four years highlights some of them. Proximo has tracked 11 project financings for Adani group companies since 2019, with a total volume of $7.89 billion (including debt and equity) and an average size of $720 million. Source: Proximo Intelligence

Source: Proximo Intelligence

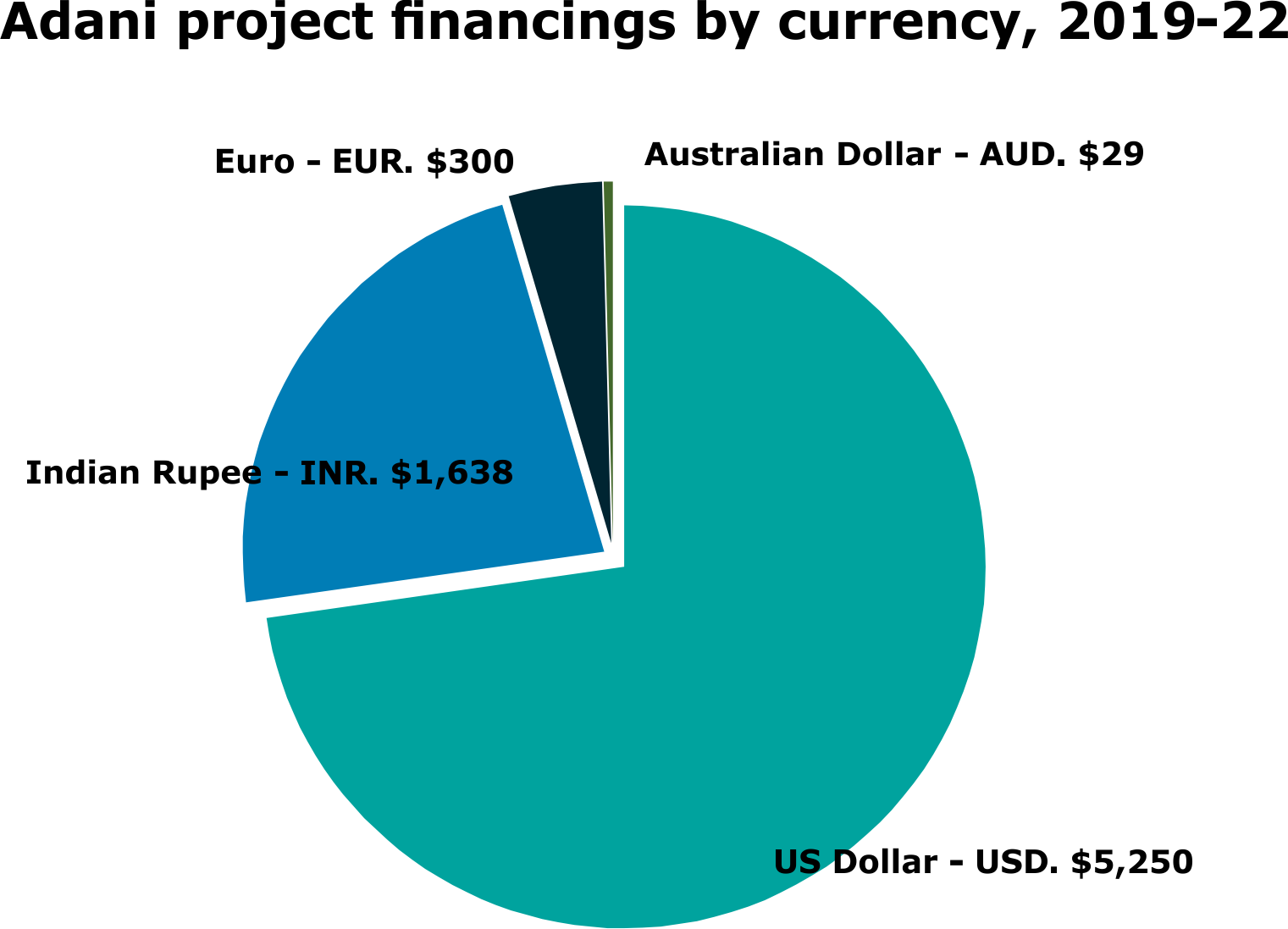

The bulk of those financings (99% by volume) were for Indian assets, though US dollars accounted for about 73% of the debt these entities raised. Much of Adani’s portfolio, particularly its port and airport operations, but also its smaller oil & gas business, benefits from dollar revenues. But a large chunk of the power and road portfolio earns rupees.

Source: Proximo Intelligence

Source: Proximo Intelligence

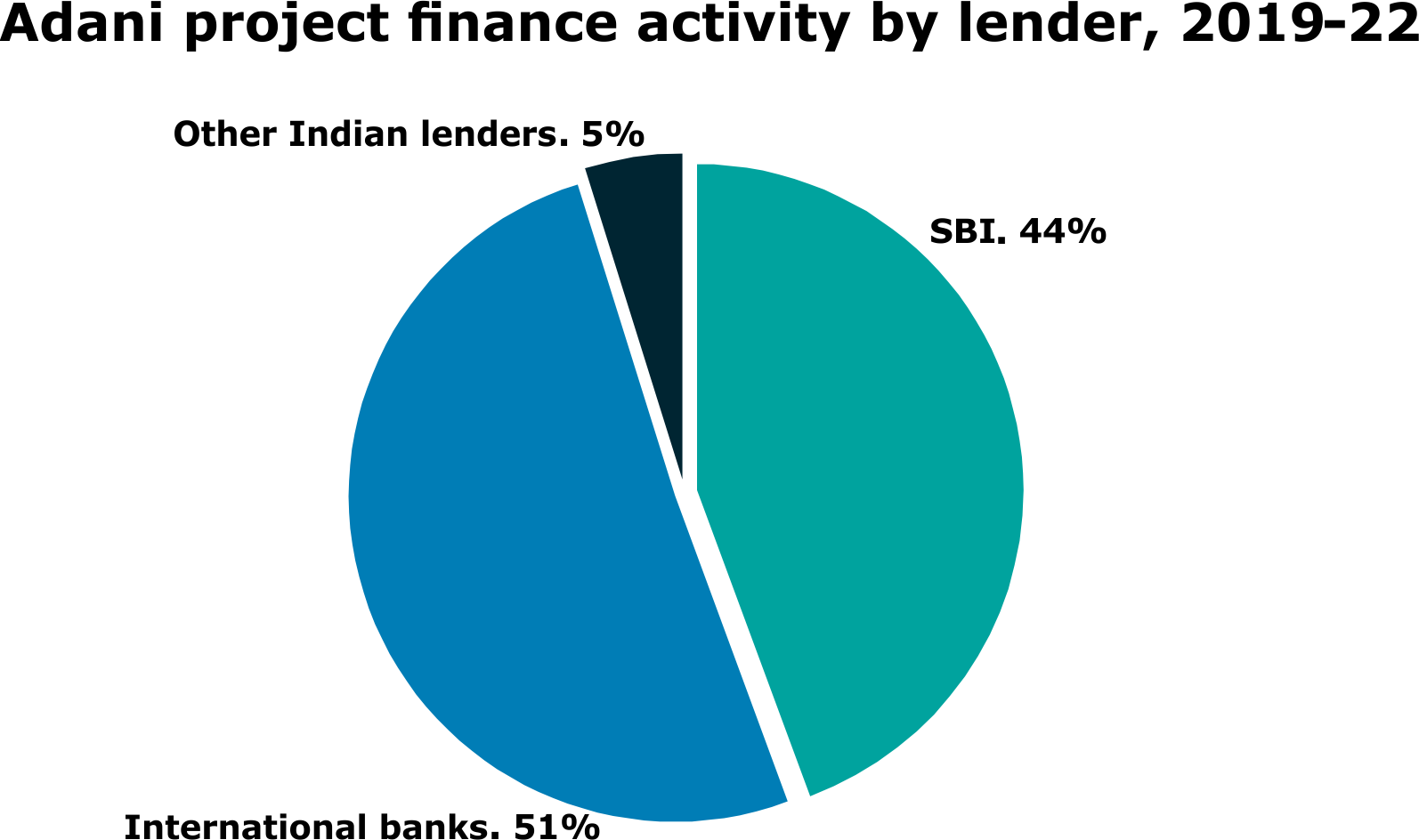

Adani’s project finance lending group reflects that currency mix. One lender – State Bank of India – accounts for 44% of the Adani Group’s total project finance lending since 2019. Its volumes are concentrated in two transactions - the Navi Mumbai International Airport and Ganga Expressway. All other Indian banks combined account for only 5%, while international banks comprise the remaining 51%.

Source: Proximo Intelligence

Source: Proximo Intelligence

It is 24 years since India passed the Foreign Exchange Management Act, and external commercial borrowings are still a rare and arduous process for India’s project finance sponsors – or promoters, as they are known in India, in defiance of global convention. India’s banks do sometimes loosen their lending processes – as has happened in previous decades in the roads and power sector. But the results for those lenders’ balance sheets were often highly damaging. As result central government had to devote large amounts of energy to getting bad or capital-hungry loans back off their books.

Still, it is worth noting that the above volumes do not reflect corporate domestic currency loans from domestic banks, or the corporate bond issues that have become increasingly important to Adani group entities. Adani has until recently been well-regarded by international banks, even if it does not benefit from as diverse a revenue mix as its larger rivals Tata and Reliance. It is Adani’s comparatively narrow and capital-intensive business mix relative to its strong share price performances that has attracted so much negative comment.

Adani pushed back strongly against Hindenburg’s allegations. It noted that the related party transactions surrounding the Carmichael rail project in Australia look a lot less like elaborate schemes to shift losses than the normal risk-reward allocation that takes place in a project financing involving sister companies with overlapping but not identical ownerships. Hindenburg also described a group company making a large loan to a sister company, when, said Adani, the “lender” had acquired that debt for a nominal price during bankruptcy proceedings.

But behind the debates over the identity of offshore-registered shareholders in Adani entities lies the fact that India’s equity markets are still highly illiquid, particularly for an economy of its size. And infrastructure development - particularly the development of larger and more complex assets, remains highly dependent on international banks and one large domestic lender.

If Adani’s troubles deepen, it will be very difficult to make the case for an expansion in Indian infrastructure corporates’ access to debt and equity. Given earlier episodes in the power and roads sectors that might not even be advisable. But Adani needs to be understood in the context of Indian capital markets that have consistently struggled to deliver much-needed infrastructure investment.

Selected news articles from Proximo last week

NORTH AMERICA

EverWind receives EA for green hydrogen and ammonia project

EverWind Fuels Company has received Environmental Approval for the initial phase of its $6 billion, 1 million tonnes per annum green hydrogen and green ammonia project located in Point Tupper, Nova Scotia.

EUROPE

GASCADE advances Danish-German hydrogen pipeline project

GASCADE, together with Copenhagen Infrastructure Partners’ (CIP) dedicated CI Energy Transition Fund, is planning a hydrogen pipeline from the Danish island of Bornholm.

ASIA-PACIFIC

Bangladesh road PPP nears financial close

Sponsors of a Tk33.03 billion ($447 million) PPP road project in Bangladesh — China Communications Construction (CCCC) and China Road and Bridge (CRBC) — are due to reach financial close on the DFI-backed debt package backing the scheme in Q2 this year.

MIDDLE EAST & AFRICA

SPPC selects pre-qualifiers for Taiba and Qassim power plants

Saudi Power Procurement Company (SPPC) has announced the pre-qualifiers selected to bid on four 1.8GW power plant projects - two in Taiba and two in Qassim.

SOUTH AMERICA

Cymi, Brasil Energia FIP, BNDES finance $159m Pampa transmission substation

Cymi Construcoes e Participacoes S.A. (Cymi), a subsidiary of Vinci, and Brasil Energia Fundo de Investimento em Participacoes Multiestrategia (Brasil Energia FIP), a subsidiary of Brookfield Asset Management, have closed a BRL795 million ($159 million) financing with BNDES for the Pampa Transmissao de Energia S.A. (Pampa) project.

The Proximo Intelligence subscription

Join our community of project finance professionals to get unrivalled access to unique analysis, market data and a global portfolio of expert industry events in the energy and infrastructure space. Click here to find out more