Proximo Weekly: A critical time for critical minerals finance

The energy transition is forcing banks and ECAs to engage with - or often return to - mining finance as the hunt for battery mineral resources heats up. But sponsors not only have to work on educating rusty lenders, but also need to give offtakers lessons in bankability.

There are a few ways that the 2022 version of the US Department of Energy’s Loan Programs Office differs from the 2010 version. The 2010 version generally concerned itself correcting the collapse in bank appetite for conventional renewables post-2008, with the occasional foray into other technologies.

Those other technologies enjoyed mixed results. Nuclear has so far failed to reach its potential, and has suffered from delays and cost overruns. A foray into solar panel manufacturing nearly sank the office. But its $465 million loan to Tesla was paid off in three years and showed that governments, whether through good luck or good judgment, can sometimes pick winners.

An EV focus for the LPO

The 2022 office is much more focused on the newer technologies. Nestled in its portfolio, among the conventional renewables, storage and nuclear, are two more loans to vehicle manufacturers - Nissan and Ford - and a $102 million loan to Syrah Technologies for a battery-grade graphite project in Louisiana, which was approved in July 2022.

The Biden administration more recently announced $2.8 billion in grants to EV battery and minerals projects in about 12 states, with Albemarle, Piedmont Lithium and Talon Metals among them. The grants and loans are part of a concerted effort to bring EV mineral processing and where possible mining, back onshore into the US.

“There are a variety of programmes available to developers, including the Advanced Technology Vehicles Manufacturing Loan Program, and the Title 17 programs, which enjoyed a $40 billion increase in guarantee capacity under the Inflation Reduction Act,” notes Oliver Wright, a partner at White & Case in New York.

This heightened use of financing programmes to meet the domestic challenges of the energy transition is not new. Expanding the ATVM programme to cover the battery supply chain took place in June 2021. “The LPO’s support for the EV sector goes back to the Trump administration and enjoys bipartisan support,” says Wright. “Support for the EV supply chain is considered important to national security and energy security.”

In 2020, the DoE launched a solicitation for critical minerals, with the chief aim of gaining better access to rare earths, which are overwhelmingly produced in China. But as the definition of critical battery minerals has expanded - to include lithium, cobalt, nickel and arguably even copper - so has the need for support.

The role of ECAs in lining up EV minerals

Governments can generally work to finance the supply of battery minerals on three fronts. The first is to use domestic financing programmes to support the extraction and processing of those minerals. The second is to use soft bilateral DFI financing to maintain access to those minerals in friendly companies. The third is to finance their acquisition directly.

The US LPO initiatives are a good example of the first. A good example of the second is the $90 million loan that JBIC mobilised for Latin American DFI CAF in May 2021. The ostensible purpose of the loan was to help with relieving the effects of COVID in the region, though JBIC was happy to add that Argentina and Bolivia are both major suppliers of lithium carbonate and zinc ore to Japan.

The third option - explicit support through ECAs for the acquisition of critical battery minerals - is only going to become more common. The 2020 financing of the Northvolt battery factory in Sweden, whose $1.6 billion debt package featured KfW-IPX, the EIB, NIB, Kexim, Euler Hermes, NEXI and BPI France, looks like a good foretaste of the enthusiasm.

The social and environmental risks attached to mining - and even the governance issues created by mineral wealth - have made financing mining projects challenging for both commercial banks and ECAs without active domestic mining industries. Mining accounts for less than 3% of global project finance volumes since 2019, according to Proximo Intelligence data. While big-ticket ECA-backed deals can command large lender followings, in general mining is the preserve of a small number of specialist banks.

There are precedents for ECA financing for critical minerals acquisitions. In the last five years KfW IPEX-Bank has made three loans to copper projects that benefited from cover under Euler Hermes’ UFK scheme, which is explicitly designed to support Germany’s import of raw materials. Both JBIC and Kexim have supported LNG and other oil & gas projects based on offtake agreements with domestic utilities rather than the export of equipment.

In September 2022, Kexim provided a $55 million direct loan and extended $45 million in guarantees to Sociedad Química y Minera de Chile, which is developing lithium resources in Australia, and has agreed a 10-year $470 million lithium supply agreement with a group of Korean importers, chief among them LG. SQM is expanding aggressively outside Chile, as well as spending $1.5 billion to make its domestic operations more sustainable.

A new breed of offtaker

The last 12 months have been dominated by announcements of offtake agreements. In December 2021, Tesla reached an agreement to buy four years of graphite from Syrah. In August, a joint venture of Toyota and Panasonic agreed to buy 4,000 tonnes per year of lithium carbonate from Australian-listed Ioneer's Rhyolite Ridge lithium-boron project in Nevada. The US location of the Ioneer project will give it a large number of options when it reaches the financing stage.

Other offtakers are even more aggressive. General Motors is making a $198 million prepayment for six years of access to lithium produced from Livent’s operations in Argentina and the US. Prepayments are a common feature of mining finance - usually made by dedicated funds for access to by-products of mining operations - though repayments under these facilities are typically indexed to a liquid benchmark, and battery mineral benchmarks can be volatile.

“In general one of the most important things that the manufacturers can bring to the table is an offtake agreement, ” notes White & Case's Wright. “In general they are used to buying from Chinese producers on a short-term basis, so shifting to long-term can be a challenge.”

But the rush to access critical minerals is prompting manufacturers to offer generous funding to suppliers. In September, SK agreed to buy 25,000 tonnes per year of lithium from Lake Resources’ Kachi project in Argentina - about half the project’s output - as well as take a 10% equity stake in Lake. The developer says it has received expressions of interest from UK Export Finance & Canada’s EDC in the debt financing for the $544 million project.

According to the developer, the debt package could have a tenor of 10-11 years, an all-in debt cost of 4.25%, and gearing of 70%. Given current debt market conditions, and lenders’ limited historic interest in Argentina, those terms would be impressive, if Lake can take them to signing. With EDC - a commercially-minded and very mining-friendly ECA - on board, Lake has a good chance of making it through due diligence in one piece.

ECAs and market risk

For some ECAs the learning curve may be a little more steep. US Ex-Im has been an occasional participant in mining deals - most notably the $7.2 billion debt package for Hancock Prospecting’s Roy Hill iron ore mine in Australia. But its activity in the mining sector has been limited to equipment exports rather than raw materials imports. The United States International Development Finance Corporation, which was relaunched in 2019 with the explicit aim of using development finance to support US foreign policy objectives, may be better placed to secure supplies in frontier markets.

Lenaig Trenaux, global head of mining, metals and industries finance at Societe Generale Corporate and Investment Banking, notes “there is keen interest in critical minerals on the ECA side, and the current OECD arrangements support their involvement, though in some instances there will need to be an adjustment to their mandates.”

One of the main challenges for developers and lenders is the absence of liquid markets for lithium and graphite. This means that banks are unable to offer hedging products. SG’s Trenaux notes that cobalt, which appears most of the time as a byproduct, might be eligible for a prepayment financing. But she notes that a fast-evolving market, combined with manufacturers’ historical dependence on just-in-time supply chains, are leading to dislocations.

Those dislocations will create opportunities. For instance, increasing scrutiny of the environmental impact of minerals processing, as well as political pressure to onshore more the battery supply chain, will create opportunities to finance processing facilities in developed countries. For banks with lower tolerances for resource or political risk these may be tempting candidates for financings, thinks White & Case’s Wright, though DFIs are also obvious sources of debt.

Rounding out capex requirements

The last part of the critical minerals puzzle will be identifying the best sources of equity. Vehicle and battery manufacturers might be willing to take minority stakes to line up the most promising reserves. But competition from listed equity is likely to be intense, and not just from traditional sources such as the Australian and Canadian capital markets. While the bloom has come off the special purpose acquisition company (SPAC) boom, European Lithium recently agreed to merge with a SPAC called Sizzle Acquisition, valuing the new entity, called Critical Minerals, at $972 million.

Battery minerals might be able to attract a new type of investor however “US capital markets have not historically seen many listings for mining ventures,” notes Wright at White & Case, “we are seeing some uplistings and secondary listings. There is institutional interest, given that these minerals have an energy transition story and good ESG credentials.”

And there is likely to be much greater interest in these minerals from the larger miners. In March, Rio Tinto paid $825 million to acquire the Rincon lithium project in Argentina from private equity firm Sentient Equity Partners. South Africa’s Sibanye Stillwater, which primarily focuses on gold and platinum, has increased its stake in the Keliber lithium hydroxide project in Nevada to 85%, and has been making smaller investments in downstream projects. It is likely to be out to market with a proposed debt package of at least €250 million to round out the €588 million’s capital expenditure requirements.

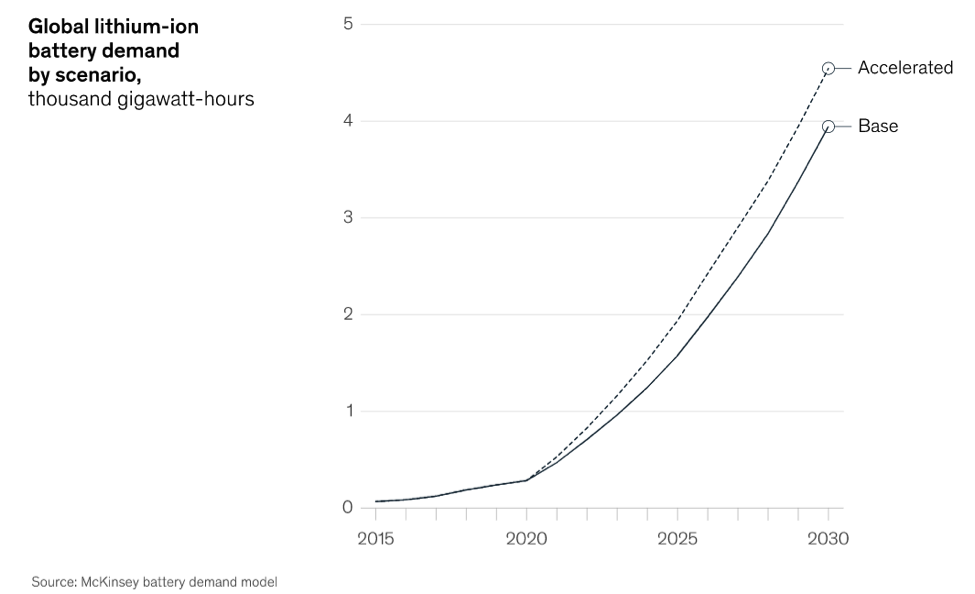

How these new sources of debt and equity work together - not to mention how they work with untested offtakers - will be a key challenge for batteries minerals finance. Fortunately, even the most conservative demand forecasts predict a bumper performance for resource developers.

Selected news articles from Proximo last week

NORTH AMERICA

PennDOT Major Bridges P3 to sign $2bn PAB deal

Macquarie Infrastructure Developments and Shikun & Binui (S&B) are expected to sign a $2 billion private activity bond financing for PennDOT Major Bridges P3 on 22 December.

EUROPE

Orsted takes full ownership and FID on FlagshipONE

Orsted has taken a final investment decision on the 50,000 tonnes/year FlagshipONE e-methanol project.

ASIA-PACIFIC

Winners announced for 3 Uzbek solar projects

Uzbekistan’s Ministry of Energy has announced the winners of its tender for the construction and operation of three solar projects.

MIDDLE EAST & AFRICA

NEOM green hydrogen plant signs facility agreements

NEOM Green Hydrogen Company (NGHC) has signed facility agreements with banks and has executed a commitment letter with Saudi Industrial Development Fund (SIDF).

SOUTH AMERICA

Mato Grosso signs preliminary deal for transfer of road concession

The Government of Mato Grosso has resolved the impasse for the transfer of share control of BR-163 Rota do Oeste highway concession.

The Proximo Intelligence subscription

Join our community of project finance professionals to get unrivalled access to unique analysis, market data and a global portfolio of expert industry events in the energy and infrastructure space. Click here to find out more