Proximo Weekly: Does the Lekela sale make African renewables a mainstream asset?

The $1.5 billion sale of the Lekela Power portfolio is a milestone for African renewables in terms of transaction size. But does it suggest that the continent’s power generation sector is now an attractive target for mainstream strategic and financial investors?

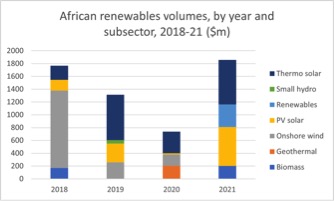

To get an idea of how big a deal the Lekela Power transaction is, compare it to total financing volumes in African renewables over the last four years. According to Proximo’s Playbook, the average annual total financing volume for renewables in Africa between 2018 and 2021 is about $1.4 billion.

Source: Proximo Playbook

The enterprise value of the Lekela wind portfolio, which comprises 1,035MW of operational capacity and a 1,800MW development pipeline, is $1.5 billion according to Aker Horizons, the Oslo-listed renewables investor that is the majority owner of one of the sellers.

The sellers are UK-based private equity firm Actis, which owned 60% of Lekela, and Mainstream Renewable Power Africa Holdings (MRPA), with the remaining 40%. MRPA itself comprises Mainstream Renewable Power, the IFC, the IFC African, Latin American and Caribbean Fund (ALAC) and the IFC Catalyst Fund, the Rockefeller Brothers Fund, Ascension Investment Management and Sanlam. Aker Horizons owns 54.4% of Mainstream Renewable Power.

While the MRPA shareholdings are undisclosed, in the 2015 fundraising that established the investment vehicle, Mainstream contributed $60 million in equity and the remaining shareholders $117.5 million between them. Aker Horizons said that Mainstream had realised $90 million in net proceeds from the sale.

The buyer is a joint venture of the Africa Finance Corporation and Infinity Group, an Egyptian renewables developer. Infinity’s shareholders in turn include the Emirati sovereign wealth fund Masdar and the European Bank for Reconstruction and Development, the latter of which paid $60 million for an undisclosed stake in Infinity in 2020. The acquisition takes the size of the portfolio that the two buyers jointly own from 400MW to over 1,400MW.

The composition of the portfolio roughly mirrors the contours of Africa’s renewables market. It comprises 110MW Perdekraal East, 140MW Kangnas, 79MW Noupoort, 138MW Loeriesfontein and 137MW Khobab, all in South Africa, 252MW West Bakr in Egypt and 159MW Taiba N'Diaye in Senegal. The plants came online between 2017 and 2021. Mainstream was conspicuous by its success in South Africa’s various renewable energy procurement rounds.

Source: Proximo Playbook

Actis has been actively looking to monetise its renewables portfolio. In June Actis and Mainstream closed on the $685 million sale of the 332MW Aela Energia wind portfolio in Chile, and Actis is also in the process of selling BioTherm Energy, an Africa-focused solar developer with a 400MW generating fleet.

The Lekela assets attracted a reasonably deep bench of bidders. Two Chinese buyers - CNIC and Sinopec - a South African coal producer, Exxaro and Globeleq, a renewables developer controlled by the UK’s CDC, are all understood to have looked seriously at the assets. But there is little sign that major global infrastructure funds or industrial buyers are a natural fit for businesses like Lekela.

The Proximo perspective

There’s often a sense in African renewables that a relatively small number of buyers with the risk appetite or impact mandate for the continent are shuffling assets and shifting between various parts of projects’ capital structure. That CDC, the former parent of Actis, was one of the most serious bidders for Lekela will do little to dissipate that impression.

Still, there are other, slightly more positive, lessons to be drawn from the sale process. If the Rockefeller fund made a respectable return on its investment it could do wonders for the interest of other philanthropic investors in the region. Mainstream’s aggressive bidding in South Africa turned out to be sustainable, even if the financial health of the country’s power sector remains a cause for concern.

And Lekela may not be the model for future asset development, consolidation and sale processes in Africa. Its onshore wind portfolio looks like eventually being overshadowed by solar, which is becoming cheaper and is generally more reliable and lower maintenance than wind. That’s certainly the impression left by recent financing activity. Onshore’s last bumper year was 2018, and 2021 registered no transactions at all.

Source: Proximo Playbook

Selected news articles from Proximo last week

OPG issues inaugural nuclear green bond

Ontario Power Generation has issued a $300 million nuclear green bond, a first-of-its-kind for the company.

NeuConnect project reaches financial close

The £2.4 billion ($2.86 billion) NeuConnect project - a new energy link between two of Europe’s largest energy markets – has reached financial close.

Octopus launches A$10bn Australian renewables platform

Octopus Investments Australia has launched a A$10 billion ($6.9 billion) platform to finance the full renewables life cycle, from development, construction and long-term operations.

South African energy storage, PV solar project reaches financial close

Scatec has reached financial close and is starting construction of the three Kenhardt projects in the Northern Cape Province of South Africa under the Risk Mitigation Independent Power Producer Procurement Programme (RMIPPPP).

SOUTH AMERICA

SBM Offshore seals $1.75bn deal to finance fourth FPSO project in Guyana

Dutch floater specialist SBM Offshore has completed a $1.75 billion project financing of One Guyana floating production storage and offloading vessel set for ExxonMobil’s Yellowtail development, located in the Stabroek block offshore Guyana.

The Proximo Subscription

Join a brand new subscription providing access to unique analysis, market data and a global portfolio of expert industry events in the energy and infrastructure space. Click here to find out more