Making CCS the lynchpin of the transition

LIVE 30/6/22 4pm UK/11am NY. A look at the economic, technical and financial aspects of scaling up carbon capture and storage technology

MEMBERS MAY VIEW THIS WEBINAR AT THIS LINK.

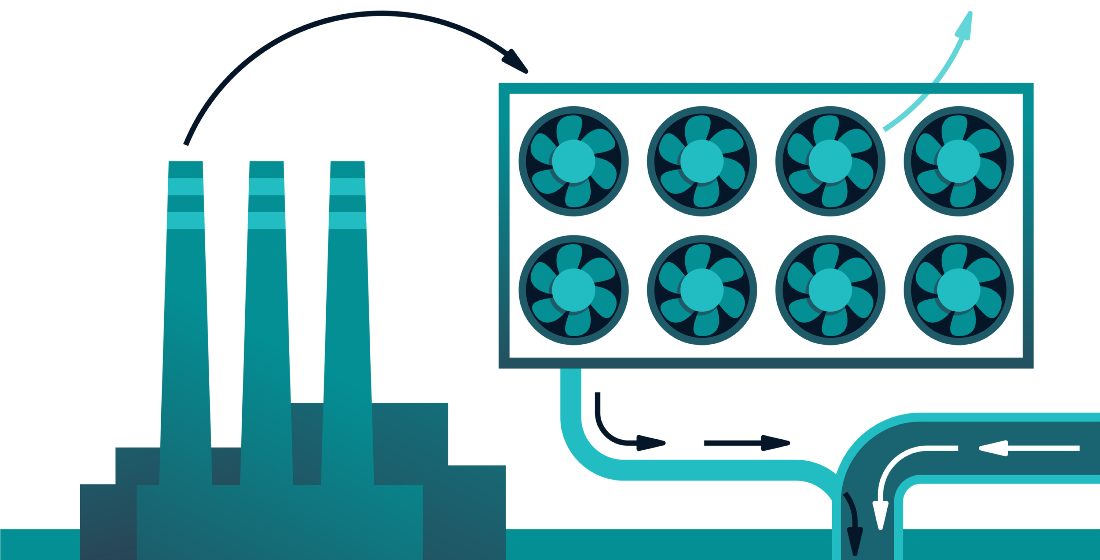

Renewable energy may have been a star performer in Proximo’s 2021 data, but the pace of development is unlikely on its own to meet governments’ ambitious decarbonisation goals. So carbon capture remains an extremely promising option for reducing the carbon footprint associated with conventional power generation. With energy security concerns challenging even more countries’ abilities to decarbonise, the technology looks even more attractive.

But while the technology has been applied at scale for a long period, large-scale independently financed CCS projects are still rare. Interface risk and geological risk could still challenge lenders, and large utilities or oil majors may choose to finance development on-balance sheet. The CCS supply chain may require credit enhancement.

There are an exciting variety of tools available to CCS developers, including tax equity in the US and potentially the regulated asset base (RAB) approach in the UK. Measuring, allocating and pricing the economic and technical risks attached to CCS within those financing frameworks will be a priority for both debt and equity in the coming months and years.

Joining Proximo will be a variety of market participants to assess how CCS technology will interface with existing and planned investments in energy infrastructure, and what the key considerations for lenders should be.

- Tom Nelthorpe, Proximo (Moderator)

- Jonathan Yates, director, deal advisory, RPS

- John Marciano, partner, Allen & Overy

Proximo members can access the webinar directly here. Not yet a member? Find out more here.