Proximo Weekly: Biomass bugs

Not all biomass has the same green credentials. But credit concerns, as much as policy issues, should drive biomass wariness.

It has long been an open secret in European energy policy that biomass – and particularly forest biomass – has been key to the continent’s progress to date in increasing its use of renewable energy. Biomass has been integral to district heating systems, and European companies have led the way in developing biomass-fired boilers for residential and commercial heating systems.It can be co-fired alongside both coal and straw in power stations, and is relatively easy to process and transport. Consequently, biomass has been eligible for support under the EU’s Renewable Energy Directive, and is a key component of the UK’s Renewable Heat Incentive.

The main justification for the use of forest biomass is that while it involves releasing stored carbon into the atmosphere, that carbon will be locked up again relatively quickly, at least compared to coal and gas, if that biomass is produced sustainably. Waste from newer plantation forests, say, or small amounts harvested from growing forests should be considered eligible.

But the scale of biomass use in Europe has led to accusations from NGOs that there is no way that wastes and thinnings could be meeting this demand. About four years ago, a television documentary team followed suppliers to Enviva, a US pellet producer that helps meet demand from the UK’s Drax, and captured footage appearing to show that whole trees from old-growth forest were being used to produce biomass fuel.

Both LSE-listed Drax and NYSE-listed Enviva said that the footage was not typical, but criticism has lingered of the environmental effects of burning biomass. This criticism culminated in the decision of the European Parliament’s Committee on the Environment, Public Health and Food Safety that forest biomass should be excluded from eligibility for subsidies under the Renewable Energy Directive.

The vote has primarily symbolic importance, given that the full European Parliament member states need to approve further restrictions. The European Commission had already proposed a tightening of the sustainability criteria for biomass that would also have restricted the ability of heat and power producers to use primary forest products.

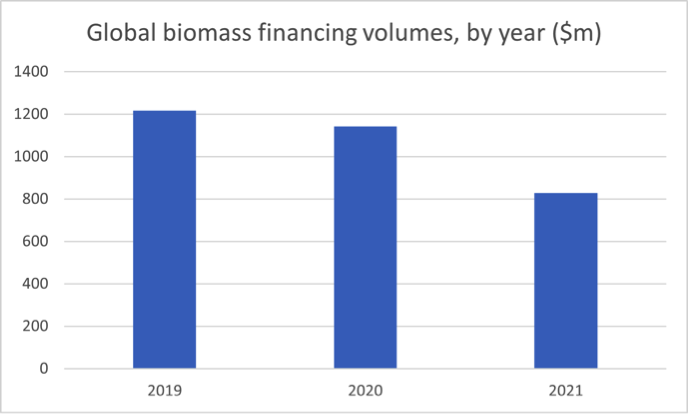

But an influential minority of EU states, and several members of the commission, want to continue using woody biomass. The volumes of financing for biomass worldwide, something of a niche within the power sector, dropped a little in 2021, but not drastically.

Source: Proximo Playbook

European states looking to decarbonise their generating fleet are still considering Drax, which has converted 2.6GW of its flagship plant’s 3.9GW of capacity from coal to biomass, as a sound example. Both AES and ContourGlobal, which each own units at the Maritza East lignite-fired power complex in Bulgaria, are reported to be considering converting to, or at least co-firing with, biomass. And earlier this year, Germany included 600MW of biomass capacity in its latest round of renewables tenders.

Biomass generators will continue to make the case that they are best placed to quickly displace coal as a fuel source. If they can bolt on carbon capture and storage technology, preventing that carbon from re-entering the atmosphere (on a long enough timeline), then they can make a better claim to carbon neutrality. National Grid is developing a 120km pipeline to carry carbon dioxide from Drax and other big emitters in the region out to geological formations in the UK North Sea.

But there are still big challenges to financing large-scale biomass projects. Woodchip fuel handling systems are prone to faults. The conversion of Drax from coal to woodchip happened in large part because the UK government was willing to guarantee a £75 million loan. Another UK-guaranteed financing, the £48 million bond issue for the 13MW (10MW steam) Speyside combined heat and power plant, had to be restructured, and was only paid down with the sale of the plant to the unlisted Greencoat Renewable Income fund.

The longest-running power plant running on waste wood – the 27MW Snowflake White Mountain – has had a similarly troubled history since it came online in 2008. It was designed to run on residues from forest fires, as well as waste from a nearby paper mill. But the collapse of the mill required a series of restructurings and changes of ownership. Its current owner, NovoPower, is led by the plant’s original developer, a local businessman and politician called Bob Worsley.

There are potential alternative uses for woody biomass, and potential alternative sources of biomass. Drax co-fires a small amount of a perennial grass called biomass, as do three smaller power stations that primarily burn cereal straw. Several developers are looking to turn waste and primary wood into biochar, essentially charcoal, which has the potential to lock up carbon more securely and improve soils. But biochar’s business model will depend on finding both suppliers and customers that are sufficiently willing and creditworthy.

For now, the momentum for large-scale woody biomass development has not slowed substantially. But the environmental committee vote, and lingering concerns about construction and operations risk, have the potential to slow the pace of the technology in the future.

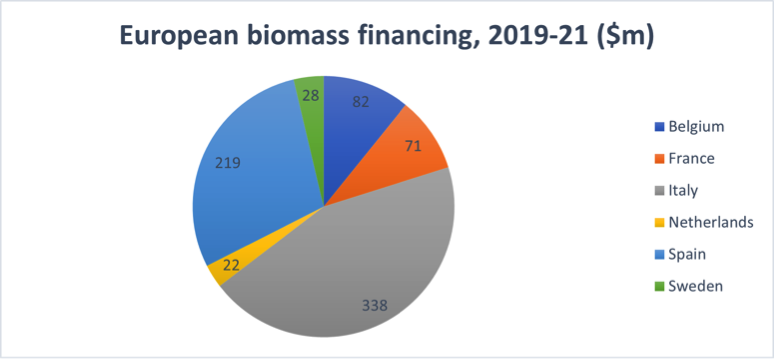

Source: Proximo Playbook

Selected news articles from Proximo last week

Nouveau Monde receives EOIs for project financing

Nouveau Monde Graphite has reported progress on its financing efforts for the development of its fully vertically integrated phase-2 operations, combining the Becancour Battery Material Plant and Matawinie Mine in Quebec.

The Netherlands formalises plans for 10.7GW of offshore wind

The Council of Ministers in the Netherlands has formalised its plans for new offshore windfarms. An initial tender for the new windfarms, which will supply 10.7 GW of energy, will open in 2025.

Financial close for Edify's NSW battery

Edify Energy and Federation Asset Management (FAM) have reached financial close on a 150MW/300MWh battery energy storage system (BESS) project in south-west New South Wales.

EWEC receives proposals for Mifra 2

Emirates Water and Electricity Company (EWEC) has received proposals for the development of its new Mirfa 2 (M2) Reverse Osmosis (RO) Independent Water Project (IWP).

SOUTH AMERICA

Lake Resources appoints Citi and JP Morgan to lead Kachi project financing

Lake Resources has appointed Citi and JP Morgan as joint coordinators for the Kachi Lithium Project, in Argentina's Catamarca Province.

The Proximo Membership

Join a brand new community of project finance professionals getting unrivalled access to unique analysis, market data and a global portfolio of expert industry events in the energy and infrastructure space. Click here to find out more