The odd couple: Financing mining’s renewables transition

The mining industry is slowly starting to switch over to more renewable forms of energy. A new kind of environmentally conscientious financing could help with that process – if done right and policed independently.

At the end of January, a report from consultancy McKinsey asserted that the world’s biggest miners were failing to meet the goals of the Paris Climate Accords and should implement more aggressive strategies to lower their greenhouse gas emissions.

The mining giants have only just started to put in place strategies – ranging from zero to 30% emissions reductions by 2030 – and are falling far short of the requirements of the agreement, said the report.

Nonetheless the industry as a whole is – if perhaps slower than it should be – beginning to transition over to renewable energy to power its operations. And a new brand of environmentally friendly financing should help with the process, even if that itself is far from the finished product.

Mining’s growing use of renewable power

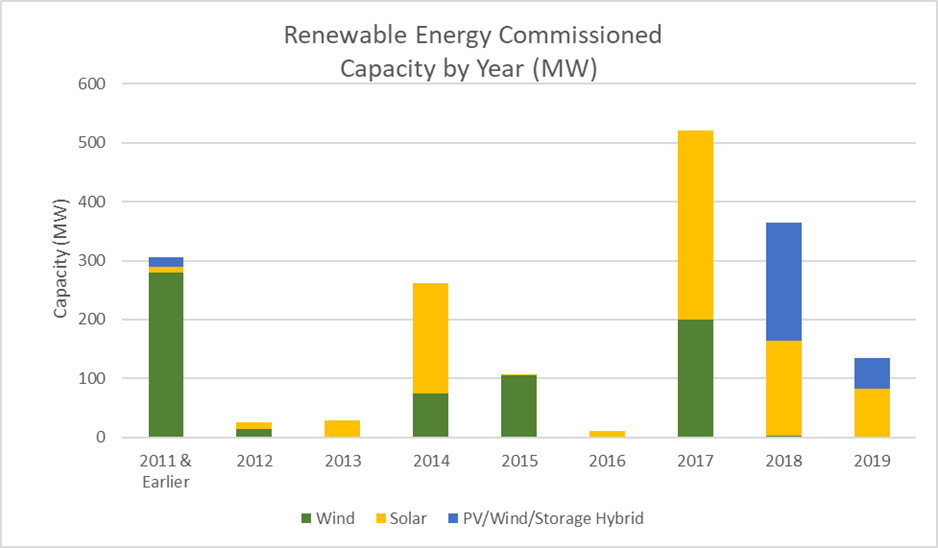

The mining industry’s use of renewable energy is now increasing by several hundred megawatts (MW) a year. Examining data from US sustainability consultancy the Rocky Mountain Institute (RMI), there is significant year to year variation but generally the industry’s renewable energy capacity is trending upwards on a three-year cycle (see graph). And last year, mining companies announced plans to commission over 2GW of renewable energy. “Looking to the future, the speed of the transition will accelerate; the announcements for new renewable energy projects are increasing rapidly,” says RMI’s mining expert, TJ Kirk.

South Africa’s Gold Fields said in June it planned to primarily operate its Agnew gold mine in Western Australia using renewable energy. The transition is a partnership with energy powerhouse EDL and includes a A$112 million ($77.59 million) investment in a microgrid combining gas, solar, wind and battery storage, which will initially cover 55-60% of the mine's energy requirements. The Australian Renewable Energy Agency (ARENA) is contributing a recoupable A$13.5 million to the construction of the microgrid, which will be owned and operated by EDL.

In May, Rio Tinto announced it would reduce the carbon footprint of its Kennecott Utah copper mine by up to 65% by replacing its coal power plant with renewable energy certificates. The mine’s electricity will now come from 1.5 million megawatt-hours (MWh) of renewable energy certificates purchased from Rocky Mountain Power.

In February last year, UK-based power generation company Aggreko was contracted to create a hybrid solar-battery generation system to power the Gold Fields-owned Granny Smith mine in Western Australia. The hybrid system is one of the world’s largest renewable energy microgrids, powered by more than 20,000 solar panels and backed up by a 2MW battery system. The microgrid is expected to reduce the mine’s fuel consumption by up to 13% and produce about 18GWh of clean energy annually.

And in June 2018 Chilean copper miner Antofagasta and utility company Colbún penned an agreement to make the Zaldívar mine the country’s first to operate with 100% renewable energy. From mid-2020, Zaldivar will use 550GWh per year of a mix of solar, hydro and wind– reducing emissions equivalent to 350,000 tons of greenhouse gases annually. The agreement will take effect in July and last for ten years.

“Real cost-savings as well as ESG benefits”

Renewable energy is cost-effective even for grid-served mines, but according to Kirk there are several characteristics that can make renewable energy particularly attractive for a specific mine: the availability of strong natural renewable energy resource, such as high winds or solar insolation; for remote mines running on trucked-in fuel; in regions with unreliable or expensive grid power; in regions with well developed renewable energy industries able to provide low-cost renewable energy; or in areas with strong regulatory or cultural pressure to adopt renewable energy.

With those characteristics in mind, there are several regions experiencing higher uptake of renewable energy by miners: in Chile, which has strong wind resource and high elevation remote mines; in Australia, which has strong solar resource, remote mines, and growing cultural pressure for the renewables transition; in southern Africa, which has unreliable and expensive grid power; and the US, which has strong renewables resources, growing cultural pressure, and and a developed renewables industry.

Few energy transition projects in mining are done solely for ESG compliance, unless the government or another body is subsidising the cost — such as for the $40 million Sandfire Resources DeGrussa Copper/Gold Mine solar project in Western Australia, which in 2016 tapped the Clean Energy Finance Corporation (CEFC) for debt and ARENA for recoupable grant funding. “The bulk of renewables adoptions are being driven because there are real cost-savings as well as ESG benefits,” says Kirk.

The overall amount of renewable energy provided by non-hydro to the mining industry is still relatively minimal today. The environmental impact is difficult to estimate in real terms as it depends on what source of energy is being displaced: grid vs on-site generation from diesel or HFO, for example. However, “on an asset level, the individual impact can be quite significant,” says Kirk.

As a rule of thumb, without changing operations or adding energy storage, a solar array should be able to cost-effectively displace 30% of a mine’s total electric load. If the mine can electrify more processes (such as hauling and underground equipment), add energy storage, add another renewable source (such as wind that blows more at night), and shift operations, 80-90% renewable energy transition is possible and cost-effective.

Growing recognition of green and ESG-linked loans

The mining industry is a broad range of companies, from very large to very small, and the extent of a company’s renewables transition very much depends on where it falls on that spectrum. “The transition, at least with respect to existing operating assets, seems to be happening first by the bigger companies. Likely it will filter across to smaller operations,” says Cynthia Urda Kassis, co-head of the Metals & Mining practice at Shearman & Sterling. However, for greenfield projects, new mines – for both large and small miners – are being developed with renewable power sources built into the project plan upfront.

To finance the renewables transition, miners have generally tapped their own balance sheet if they're doing the renewables project themselves. But if they’ve outsourced it to a renewable energy company, that company will typically fund the project using project finance.

To transition the brownfield assets, the big mining companies are using their cash flow and their corporate facilities at the holding company level. “The numbers aren’t that big for them,” says Kassis. “As a result these projects are often treated as general capex. There are, however, some examples where green loans and green bonds are being used to fund these costs. Use of these funding sources is helpful in highlighting publicly that these transitions are taking place.”

For the mid-tier miners, although much depends on their size and how they’re doing financially at the time, they’re more likely to borrow on their corporate revolver to finance the transition, or use a green loan or an ESG-linked facility.

The junior miners are obviously more constrained. But “we expect going forward more of them will tap these new green and ESG-linked facilities,” says Kassis. “Loan facilities, in particular, are likely to be used by smaller companies for which a bond offering of this nature may not be practical.”

Although green bonds have been around a long time, green loans and ESG-linked loans are relatively new phenomena set up to banks and funds to be industry-agnostic lending instruments encouraging socially and environmentally sustainable investments. They’re loosely conceived instruments and could be structured as all kinds of credit product: a corporate facility, a structured facility, a project financing, a performance bond, etc. Thus far, they’ve primarily been used in Europe.

“Most mining companies don’t think of themselves as eligible for these facilities,” says Kassis. “They think they’re just there for wind farms and solar fields and the like. Lenders have been reaching out to encourage them to tap these facilities.”

There are subtle differences between a green loan and an ESG-linked loan. A green loan is one where the purpose of the loan is directly linked to a given project. So as the company draws down the funds, it uses them to directly pay the contractor for building the renewables project. For an ESG-linked loan, on the other hand, there are certain performance indicators a company needs to achieve to access a reduction in the interest rate.

There are a variety of benefits to green and ESG-linked facilities. But the reduced interest rate is probably the least of them. “Sometimes there’s a reduction and sometimes there’s not – though in any case the reduction probably isn’t significant” explains Kassis. “But use of this type of funding does make a new pool of capital from funds and even within banks available to borrow from, and it can facilitate the credit approval process. It also helps to get the word out that the company is doing positive things in the ESG area, with verification from the third-party financing.”

Greening or greenwashing?

Both green loans and ESG-linked loans are still evolving concepts at present, and there has yet to be a standardisation of what constitutes green or ESG-linked financing. Attempts are underway at the Loan Syndication and Trading Association (LSTA), which have come up with the Green Loan Principles (GLP) and the Sustainability-Linked Loan Principles (SLLP). “But some are stretching the definitions,” says a US-based project finance lawyer, who asked to remain unnamed. “A shopping mall could be built with a single solar panel in the car park and it could access green financing because it has a green component. So that’s what the standards are trying to address.”

The GLP derives from the Green Bond Principles (GBP), which were formulated by the financial industry itself to enable capital-raising and investment for new and existing projects with environmental benefits. They are voluntary process guidelines that recommend transparency and disclosure and promote integrity in the development of the green bond market by clarifying the approach for issuance of a green bond. “At the moment, they are just a voluntary set of principles that both parties agree to abide by, much like the Equator Principles. But they aren’t regulated by any specific third party,” says the lawyer.

There are a number of so-called green or environmental rating agencies that offer verification of such facilities, such as Sustainalytics, MSCI and Vigeo Eiris. “But their credentials and methodologies are dubious, and there are no agreed standards,” the lawyer comments. And neither the lawyer or Kassis believe that regulatory organisations will be verifying the facilities' credentials anytime soon. More likely they will remain self-regulated like the Equator Principles, a risk management framework adopted by financial institutions in 2010 for determining, assessing and managing environmental and social risk in projects.

From the lenders point of view, the benefits associated with providing such facilities derive from the PR related to financing green or ESG-linked projects. “So there’s a big focus on making sure the funds raised through these facilities are used for green or ESG-linked purposes, because if it came out that wasn’t the case it could discredit these types of facilities,” says Kassis.

In a green loan scenario, typically there would be diligence up front and the banks would have an independent engineer look at the project and verify its feasibility and standards. There is also often an obligation to complete the project by a certain time, with a third party verifying the project on completion. For the ESG-linked facility, it will sometimes be self-certified by the company and sometimes verified by a third party, according to the lawyer.

The Proximo perspective

For all areas of the global economy, the future has never been more difficult to predict than it is right now – and mining is no exception to that. The world is facing the potential of a protracted global recession from Covid-19, which may significantly dampen the demand for new capital-intensive projects for the next couple of years. Setting that aside, between 2017 and 2019 the announced newly commissioned renewable capacity in the mining industry tripled from 1,642MW to 4,900MW. And “assuming that the global economy doesn’t suffer a major recession, mining’s renewables uptake could increase by another 5 to 15 GW,” predicts Kirk.

But it seems unlikely there’ll be any specific financing structures developed for the mining industry to aid that process. More likely is a gradually growing recognition by both miners and financiers of the industry’s eligibility for green loans and ESG-linked loans, and a matching growth in their use in the sector.

The GLP and the SLLP will be further developed, becoming more standardised and akin to the Equator Principles. “Over time the guidance will no doubt get better,” says Kassis. “And just like the World Bank environmental guidelines and the Equator Principles, it may well be some principles will be developed that are applicable to specific industries like mining.”

All that being said, both the GLP and SLLP need far stricter oversight than they’re currently receiving to avoid justifiable accusations of greenwashing. It was much the same following the birth of the Equator Principles, when support by Equator banks for controversial projects like the 1,760km Baku-Tblisi-Ceyhan pipeline and the Uruguay-based Botnia/UPM pulp mill left people asking if the Principles had any integrity. Over time that gradually changed – even if they’re still occasionally abused today.

But one aspect that must change is the possibility of self-certification by borrowers of ESG-linked loans – as getting a miner to verify the environmental and social benevolence of their projects is like asking Winnie the Pooh to guard the honey.