Make the most of IIJA and IRA funding for infrastructure development

Two recent blockbuster bills promise to hugely increase the funding available to US infrastructure developers. Paying careful attention to structuring and to development risks will be crucial to successful project development.

Sponsored by:

The Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA) address the United States’ infrastructure deficit from two distinct angles.

The $1.2 trillion IIJA, also known as the Bipartisan Infrastructure Law (BIL), was signed into law on 15 November 2021, and is designed to rebuild the nation’s infrastructure. The IRA was signed into law by President Biden on 16 August 2022, includes at least $369 billion in climate and energy tax and funding provisions, and is the largest-ever US response to climate change.

These acts are designed to address social equity and the climate crisis, create well-paid domestic jobs, secure supply chains, and build resiliency and efficiency into the physical and manufacturing infrastructure of the US.

But understanding how to incorporate and maximise the incentives in the IIJA and IRA for larger infrastructure projects can be challenging. We offer some insights below.

Maximising renewable energy investments and infrastructure projects

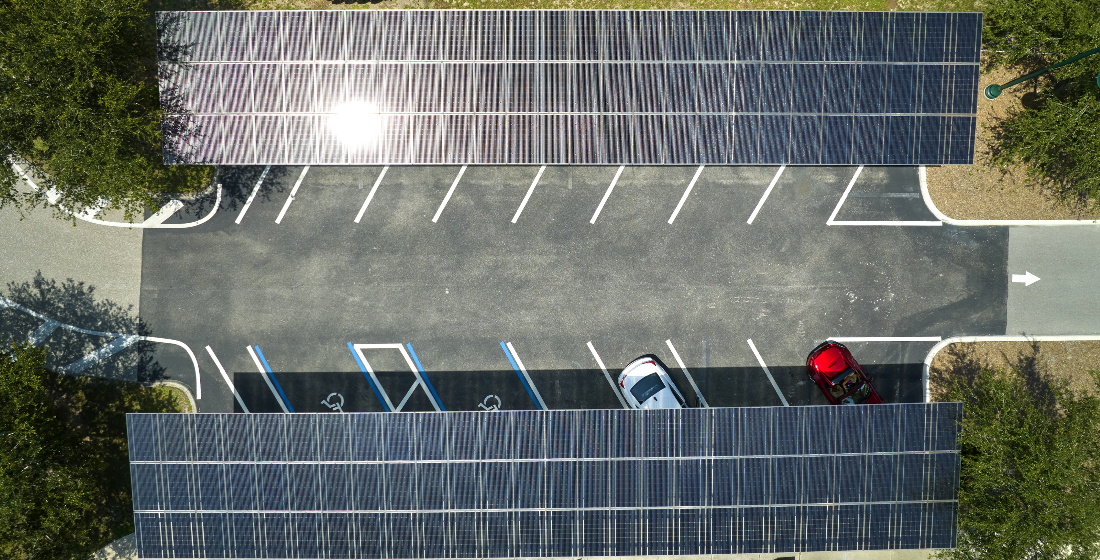

Is it possible to maximise the use of IIJA and IRA funding by incorporating renewable energy and related investments into larger infrastructure projects? One example could be adding a photovoltaic system and energy storage facility onto a new airport passenger terminal development, which might also include covering parking facilities with solar panels and adding EV charging.

The short answer is: Yes, it can be done. Generally, the IIJA allows for the inclusion of IRA-related tax structuring as a component of the overall funding package. Therefore, the example above might see FAA-administered funds awarded under the Terminals Redevelopment Program combined with a tax-advantaged structure which can increase renewable energy investment.

It might be necessary to include funding from a variety of sources, including state and local funds and, in some cases, private finance, particularly on the larger and more complex infrastructure projects. Indeed, the IIJA does nudge its recipients to consider how diverse dollars might be used together.

The combination of these sources recognises that projects can help achieve a wider number of government policies, often achieving multiple goals within one project and, therefore, can enhance the attractiveness of a funding application. Given the impact that this funding can have on affordability, developers and investors are looking to develop structures that can blend these funding sources most effectively. The power of including an IRA component is that it typically does not count against federal matching requirements, essentially allowing more federal funds to be included. However, individual programme requirements do vary, and it is important to verify the applicability in each case. We believe that over the next 12-24 months we will start to see more projects that incorporate multiple funding streams.

We believe that this approach is applicable to a range of assets that could incorporate a renewable energy or climate friendly component, including bus and train stations, public office buildings, higher education facilities, courthouses, ports, and airports, to name a few. Virtually all infrastructure can incorporate some type of climate-friendly element.

Renewable energy tax credits and incentivised investment structures

When using federal tax credits, the devil is often in the details. Developers focused on the public sector are very familiar with the discretionary grant process but structuring tax credits is generally less well understood.

With the introduction of Direct Pay, tax-exempt and non-federal government entities, including some municipal utilities, can get direct cash rebates from the US Treasury equivalent to the eligible tax credit amount for qualifying renewable energy, storage, and EV-related investments. The introduction of Direct Pay allows non-taxed entities to participate in tax-incentivised investment structures. The IRA specifically includes both extended and expanded Investment Tax Credits (ITC) as well as Production Tax Credits (PTC).

The IRA has the potential to drive investment in all kinds of electrification assets, including charging, storage, bi-directional charging for load management as well as EV charging, with or without solar energy generation or storage for backup and reliability of critical loads and operations where energy failure is not an option. In particular, battery storage could be deployed in lieu of diesel generation backup, with reduced EPA and permitting otherwise required with diesel generation operations and on-site fuel storage. Given that much of our new infrastructure will undoubtably need clean tech in the future, it makes total sense to incorporate these assets as an integral part of the project delivery process and maximise their access to funding.

Enhancing assets means increasing complexity

Incorporating clean technologies may make the development process more complex. One misconception of project delivery is that once funding is in place, that is the end of the job. This is not true. While the dollars may be available this does not mean that the project has been delivered. The period where project risks are generally at their highest is during the construction phase.

This construction phase presents the period when both cost and schedule risks are at their highest and can include a myriad of factors which influence the outturn cost, including change orders, disputes, errors, and more. There is an increasing body of evidence, particularly from the public sector, regarding the potential of planned costs to escalate before and during the process of construction, resulting in higher outturn costs for public sector owners to contend with.

Bent Flyvbjerg, the Chair of Major Programme Management at Oxford University’s Said Business School, notes in his recent book How Big Things Get Done that the key to successful project delivery is to “think slow, act fast”. This idea focuses on the premise of carefully planning the entire project delivery process, undertaking foundational information gathering, and applying critical thinking and extensive iterative testing.

During this planning phase, the cost of exploring, identifying, and testing options is relatively low. This contrasts with the execution (construction) phase which should be undertaken quickly according to a highly detailed and specific plan that incorporates a range of contingencies and mitigations. Extensive historical data on capital projects suggests this philosophy presents the most cost-effective way to deliver large projects on budget and on schedule.

Therefore, during this planning process, a project team should be thinking carefully not only about where the money will come from but the most effective way to use it. It is still common in the public sector for owners to select methods for the delivery of major infrastructure without first considering the best contractual framework under which it will be delivered, which often favours traditional tried and tested methods.

The IIJA pushes owners to consider alternative mechanisms for delivery. This assessment may include a careful analysis of the underlying risks and early decisions about how to match a contractual delivery framework with a funding plan. Incorporating IRA-incentivised investments in the project can compound complexity. For this reason, it is important to carefully assess, plan, and integrate these elements early, rather than bolt them on as an afterthought.

In our earlier example, owners may want to think carefully about whether they want to install, own, and operate charging infrastructure or whether that would be better outsourced to a third party that bears both the risks and rewards. While we believe that private sector partners will be able to bring genuine innovation and potentially cost savings to both financial and technical approaches, we also believe that owners should consider their own goals using an objective framework.

Capitalise on the opportunity: Correct planning is key

The IIJA and IRA offer significant funding for a broad range of infrastructure development. But it is important to recognise that the use of those funds alone will not restore the US infrastructure investment deficit. Public sector owners and their private sector partners are being challenged to use federal dollars as a base on which to build more innovative funding and financing structures that can get projects fully funded most effectively.

We believe that careful planning and combining federal funds – including layering state, local, and, in some cases, private dollars – often gives projects a greater chance of obtaining full funding. This process requires a careful analysis of how those sources can be combined in the most impactful ways; and, in certain cases, specialised expertise is needed. Funding sources are intrinsically linked to the contractual structures under which they are put to work and can provide opportunities for enhancing innovation, competition, and risk mitigation.

Don’t forget to register your place at Proximo Financing America's Infrastructure 2023, 23rd & 24th May, Nashville TN!

Stay on top, as we take a look into the future of US infrastructure considering the key trends in the market and what this means for years to come. The agenda covers the most interesting topics in the market such as Infrastructure as a service, structuring workshops, and fun discussions on stadium finance featuring the CFO of the Tennessee Titans to discuss their new stadium!

Gracing the stage we have key speakers such as the Deputy Governor & Commissioner of the Department of Transportation for the state of Tennessee to deliver a keynote on their most recent landmark legislation, the head of PPP for the Virginia Department of Transportation and Commissioner of Georgia Department of Transportation sharing what is in the current pipeline.

To book your ticket or for any other enquiries contact marketing@proximoinfra.com